The website What Happened in 1971 presents a compelling narrative about the economic transformations that have occurred since the early 1970s, primarily focusing on the United States.

Through various charts and graphs, it illustrates significant shifts in economic indicators, such as wages, productivity, and wealth distribution. Analyzing these changes from an Austrian Economics perspective provides a deeper understanding of the underlying causes and implications.

Economic Context of 1971

In 1971, the U.S. abandoned the gold standard under President Nixon, marking a pivotal moment in monetary policy. This shift allowed for the expansion of fiat currency and significantly altered the relationship between money supply and economic activity.

Austrian economists argue that this transition led to malinvestment—investments made based on artificially low interest rates rather than genuine consumer demand. This misallocation of resources can contribute to economic cycles of boom and bust.

Wage Stagnation vs. Productivity Growth

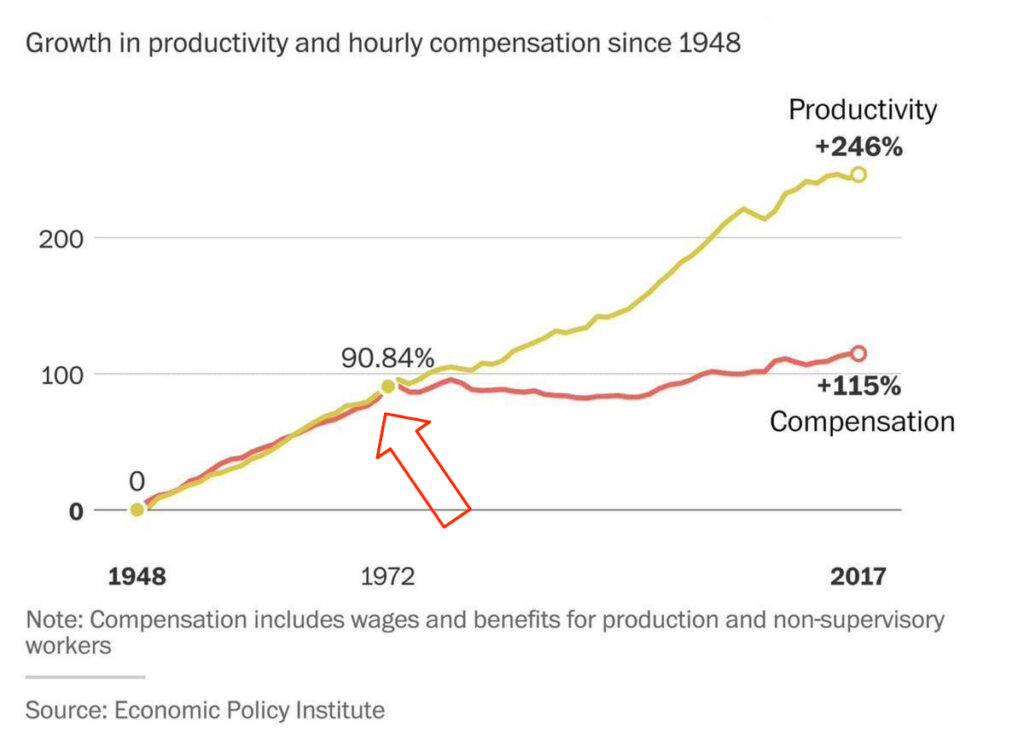

One of the most striking charts on What happened in 1971 shows a divergence between wage growth and productivity growth post-1971. While productivity has continued to rise, real wages have stagnated for the average worker.

From an Austrian perspective, this phenomenon can be attributed to monetary inflation and government intervention in labor markets. Austrian theorists contend that when money is printed without corresponding increases in goods and services, it dilutes purchasing power, leading to wage stagnation despite rising productivity.

Wealth Inequality on What Happened in 1971

Another critical graph depicts the increasing concentration of wealth among the top percentile since 1971. Austrian economists often highlight how government policies—such as monetary expansion and regulatory frameworks—favor large corporations and wealthy individuals, enabling them to capitalize on cheap credit while smaller businesses struggle.

This dynamic fosters inequality, as wealth becomes increasingly concentrated in the hands of those who can navigate the complexities of a manipulated financial system.

The Role of Debt

What happened in 1971 also features data on rising household debt levels since 1971. Austrian economics emphasizes that excessive debt accumulation is often a symptom of distorted interest rates resulting from central bank policies.

When interest rates are kept artificially low, borrowing becomes more attractive, leading to overleveraging by consumers and businesses alike. This debt-driven consumption can create an illusion of prosperity but ultimately leads to financial crises when debts become unsustainable.

Easy Money And Business Cycles

Austrian business cycle theory posits that cycles of boom and bust are exacerbated by monetary policy that artificially lowers interest rates. The data presented on What Happened in 1971 aligns with this theory; periods of economic growth were followed by downturns as malinvestments became apparent.

The disconnect between investment decisions based on distorted signals from monetary policy versus actual consumer preferences highlights the inherent risks in such an economic environment.

Government Intervention

What happened in 1971 explores various economic indicators that underscores the role of government intervention in exacerbating economic problems. Austrian economists argue that interventions often lead to unintended consequences that distort market signals, resulting in inefficiencies and resource misallocation.

For instance, policies aimed at increasing minimum wage or imposing stringent regulations can lead to job losses or reduced hiring—a point illustrated by employment trends post-1971.

The insights drawn from What Happened in 1971, when viewed through an Austrian Economics lens, reveal a complex interplay between monetary policy, government intervention, and market dynamics.

The charts illustrating wage stagnation, wealth inequality, and rising debt levels provide empirical support for Austrian theories regarding malinvestment, business cycles, and the detrimental effects of state interference in free markets. Understanding these correlations not only sheds light on past economic trends but also offers valuable lessons for future policy considerations aimed at fostering sustainable economic growth.