Asia has emerged as a powerhouse for bitcoin adoption, with diverse countries across the region embracing the world’s leading digital currency in unique ways.

From institutional investors in Singapore to grassroots movements in Indonesia, the Asian bitcoin ecosystem presents a fascinating tapestry of innovation, regulation, and community-driven initiatives.

We dive deep into the current state of bitcoin adoption across key Asian markets, providing investors with actionable insights into this dynamic region.

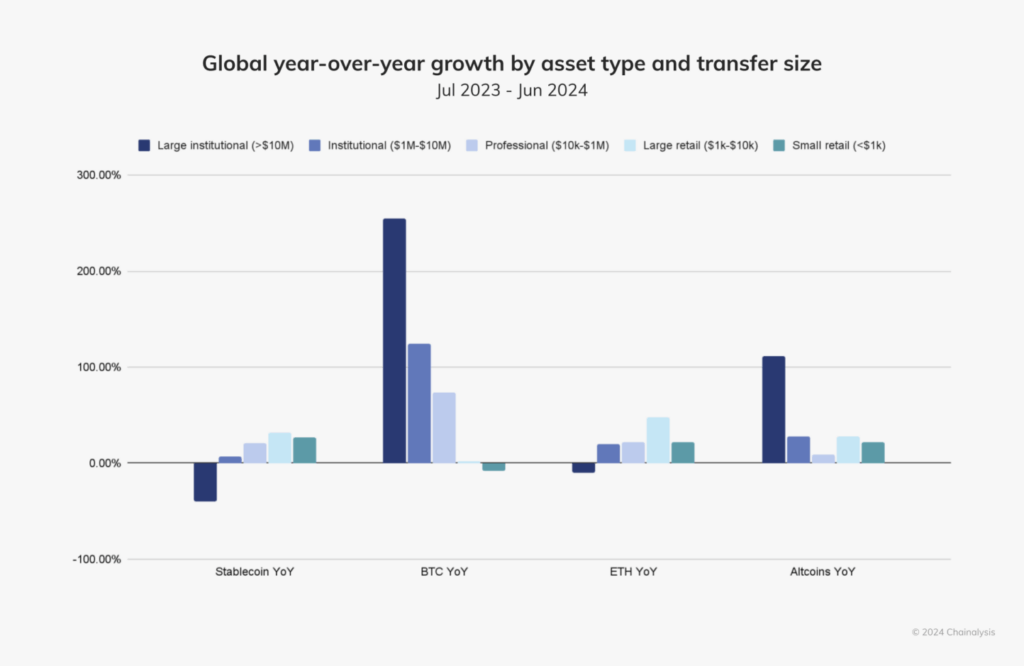

The Numbers: Asia’s Bitcoin Dominance

As of early 2025, over 500 million people worldwide hold some form of digital currency, with bitcoin remaining the most widely adopted digital asset. Asia stands at the forefront of this adoption wave, with the Central & Southern Asia and Oceania (CSAO) region leading the world in digital currency adoption according to Chainalysis’s 2024 Global Crypto Adoption Index.

The statistics paint a compelling picture:

- Seven of the top 20 countries in global crypto adoption are located in the CSAO region.

- India and China together comprise almost half of the world’s digital currency user base.

- Japan’s digital currency market is expected to reach 19.43 million users by the end of 2025, with a penetration rate of 15.93%.

Behind these impressive numbers lies a complex ecosystem shaped by diverse factors including regulatory environments, technological infrastructure, economic necessities, and vibrant community initiatives.

Country-by-Country Analysis

India: The Grassroots Powerhouse

India ranks first in Chainalysis’s Global Crypto Adoption Index, with bitcoin adoption thriving particularly in tier-2 and tier-3 cities. This grassroots movement is driven primarily by:

- Financial inclusion: Bitcoin offers banking-like services to India’s large unbanked population.

- Remittance solutions: Lower fees for the significant Indian diaspora sending money home.

- Mobile wallet proliferation: India’s high smartphone penetration enables easy access to bitcoin services.

Japan: The Regulatory Pioneer

Japan has long played a significant role in bitcoin’s evolution, from hosting some of the earliest exchanges to pioneering regulatory clarity. In 2025, Japan finds itself at a fascinating crossroads:

- The Japan Financial Services Agency is considering reclassifying digital currency assets as financial products akin to stocks, potentially enhancing user protection.

- Major corporations like Metaplanet Inc. are expanding their bitcoin holdings, with plans to increase holdings by 470% to reach 10,000 BTC in 2025.

- The country boasts a thriving grassroots bitcoin community and a strong developer ecosystem.

Bitcoin adoption in Japan is uniquely balanced between institutional involvement and community enthusiasm, with initiatives like Blockstream’s Tokyo office working to promote layer-2 solutions, self-custody, and developer education.

Vietnam: The P2P Leader

Vietnam consistently ranks among the top countries for bitcoin adoption per capita. The country’s relationship with bitcoin is characterized by:

- Strong peer-to-peer (P2P) platform usage for daily transactions and remittances.

- High mobile wallet adoption driving grassroots usage.

- Bitcoin serving as a hedge against local currency fluctuations.

- Relatively favorable regulatory attitude compared to some neighboring countries.

Singapore: The Institutional Hub

Singapore has established itself as Asia’s premier institutional bitcoin destination through:

- Clear and forward-thinking regulatory frameworks, particularly the Payment Services Act.

- Growing presence of global digital currency firms including Gemini, OKX, and HashKey, which have received regulatory approvals.

- A robust financial infrastructure catering to high-net-worth individuals and institutional investors.

While Singapore’s consumer protection-focused framework restricts promotional activities and public advertising by digital currency service providers, the city-state remains a beacon for institutional bitcoin adoption in Asia.

South Korea: Retail Dominance Transitioning to Institutional

South Korea presents a fascinating case study of a market in transition:

- Retail investors currently dominate digital currency trading volume, while institutional participation significantly lags behind.

- Experts expect institutional involvement to increase, though a significant shift may not occur until around 2027.

- The local finance watchdog recently launched a crypto committee to assess permissions for corporate digital currency investors and ETFs.

- Users must access fiat-to-digital currency services through local exchanges with official banking partnerships, linking digital currency activities to legal identities.

Bitcoin Communities: The Grassroots Movements

What truly sets Asia apart in the global bitcoin landscape is the vibrant tapestry of community-driven initiatives across the region. These grassroots movements are instrumental in driving adoption from the ground up.

Bitcoin House Bali: A Community Hub

In Indonesia, the Bitcoin House Bali project exemplifies grassroots innovation. This initiative has transformed an old mining container into a vibrant hub for bitcoin education and community engagement.

Key features include:

- Free workshops (including “Bitcoin for Beginners” and “Bitcoin for Kids”).

- Developer programs including online classes, BitDevs Workshops, and Hackathons.

- A closed-loop economic system that turns bitcoin into community points.

- Merchant onboarding—from restaurants and drivers to scooter rentals and street vendors.

Bitcoin Seoul 2025: Bringing the Community Together

The upcoming Bitcoin Seoul 2025 conference (June 4-6, 2025) represents Asia’s largest bitcoin-focused gathering, bringing together global leaders, executives, and community members.

The event will feature:

- The Bitcoin Policy Summit: Seoul Edition, providing insights into regulatory trends.

- The Bitcoin Finance Forum, addressing institutional investment and treasury management.

- A Global Bitcoin Community Assembly for bitcoin grassroots and community leaders.

- Live Lightning Network payments demonstrations at the on-site Lightning Market.

This event underscores South Korea’s emerging role in the global Bitcoin ecosystem and highlights the growing institutional interest in the region.

Regulatory Landscapes: A Mixed Picture

The regulatory environment for bitcoin across Asia presents a complex and evolving picture that significantly impacts adoption patterns.

Japan’s Regulatory Evolution

Japan is considering tightening regulations on digital asset transactions by reclassifying them as financial products similar to stocks. If implemented, these changes would:

- Require issuers to disclose more detailed information on their corporate status.

- Potentially enhance user protection.

- Come into effect after June 2025, following policy direction outlines by the administration.

Current regulations in Japan are relatively digital currency-friendly, with bitcoin recognized as a legal form of payment under the Payment Services Act since 2016.

Singapore’s Balanced Approach

Singapore maintains a regulatory framework that emphasizes market stability and consumer protection, including:

- Restrictions on promoting digital services in public areas.

- The Payment Services Act that regulates digital currency exchanges.

- A general approach that supports institutional adoption while carefully managing retail exposure.

This balanced approach has helped establish Singapore as a trusted hub for bitcoin businesses and institutional investors.

South Korea’s Transitional Framework

South Korea’s regulatory landscape is in flux, with several developments impacting the bitcoin ecosystem:

- Corporate access to digital currency is currently limited due to stringent Anti-Money Laundering guidelines.

- The prohibition on ETFs under the nation’s capital markets law restricts institutional options.

- Recent moves suggest a potential opening of the market to corporate investors, though with robust compliance requirements.

- Users need real-name bank accounts linked to their legal identities to access fiat-to-digital currency services.

What’s Next for Bitcoin in Asia

Looking ahead to the remainder of 2025 and beyond, several trends are likely to shape bitcoin adoption in Asia:

Regulatory Harmonization

As bitcoin continues to integrate with traditional financial systems, we can expect:

- Greater regulatory clarity across major markets.

- Potential standardization of compliance requirements.

- More balanced approaches that protect consumers while fostering innovation.

Institutional Acceleration

While institutional adoption varies by country, the trend is clear:

- South Korea could see significant institutional entry by 2027.

- Japan’s reclassification of digital assets may accelerate institutional integration.

- Hong Kong’s bitcoin ETF developments could influence regional approaches.

Community-Driven Innovation

The grassroots movements across Asia will continue to drive adoption through:

- Local bitcoin circular economies like those emerging in Indonesia.

- Educational initiatives reaching new demographics.

- Community-led technical innovation, particularly around Lightning Network and privacy enhancements.

As bitcoin continues its journey toward mainstream adoption, Asia stands at the forefront of this transformation. The region’s unique blend of technological prowess, regulatory innovation, and grassroots enthusiasm creates an ecosystem unlike any other in the world.

What remains clear is that Asia’s influence on bitcoin’s global trajectory will only grow in the coming years. As regulatory frameworks mature and institutional participation increases, the region’s pioneering role in shaping bitcoin’s future appears secure—making it an essential focus for any serious bitcoin investor.