In the volatile world of Bitcoin, few tools have captured the imagination of Bitcoin investors quite like the bitcoin rainbow chart. This colorful, visually stunning analytical instrument has become a cornerstone reference for traders, holders, and enthusiasts seeking to understand where Bitcoin stands in its market cycle. But what exactly is the bitcoin rainbow chart, how does it work, and can it really help you make smarter investment decisions?

Table of Contents

What Is the Bitcoin Rainbow Chart?

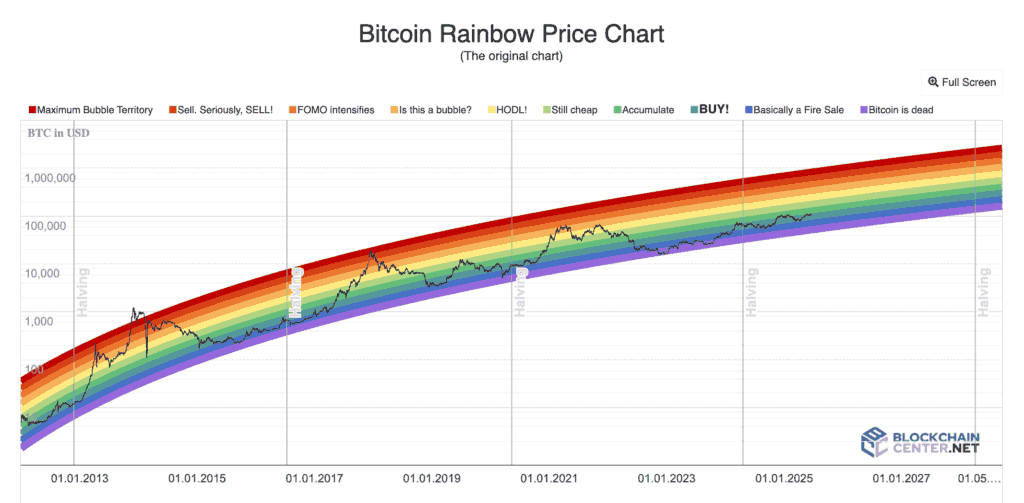

The bitcoin rainbow chart is a long-term valuation tool that visualizes Bitcoin’s historical price movements using a logarithmic scale overlaid with colorful bands. Each band represents a different phase of Bitcoin’s market cycle, ranging from “Fire Sale” (deep blue) at the bottom to “Maximum Bubble Territory” (dark red) at the top.

Think of the bitcoin rainbow chart as a weather forecast for Bitcoin—instead of predicting rain or sunshine, it shows whether Bitcoin is currently undervalued, fairly priced, or potentially in bubble territory based on historical patterns.

Created in 2014 by Reddit user “azop” (created the first visualization in 2014, which was a simple, straight-banded, colorful chart on a logarithmic scale used as a humorous way to visualize Bitcoin’s price history and boost community morale during a bear market) and Bitcointalk user “trolololo,” (independently developed a more technical logarithmic regression model around the same time in 2014) the bitcoin rainbow chart was initially designed as a humorous way to visualize Bitcoin’s growth trajectory.

However, what started as a meme quickly evolved into one of the most referenced technical analysis tools in the Bitcoin space. The chart has maintained remarkable relevance over Bitcoin’s 15-year history, accurately capturing major market cycles despite its lighthearted origins.

The genius of the bitcoin rainbow chart lies in its simplicity. Rather than overwhelming investors with complex indicators, oscillators, and technical jargon, it distills Bitcoin’s price action into an easily digestible visual format that even newcomers can understand at a glance.

How the Bitcoin Rainbow Chart Works: The Science Behind the Colors

Logarithmic Regression: The Mathematical Foundation

At its core, the bitcoin rainbow chart employs a mathematical technique called logarithmic regression to model Bitcoin’s long-term price trajectory. Unlike linear charts that show equal spacing between price levels, logarithmic charts compress large price movements and expand small ones, making it easier to visualize assets that experience exponential growth—exactly what Bitcoin has demonstrated since its inception.

The logarithmic regression curve that forms the backbone of the bitcoin rainbow chart is calculated by analyzing years of historical Bitcoin price data and fitting a curve that best represents the overall growth trend. This curve acts as the chart’s centerline, with colored bands distributed above and below it at mathematically determined intervals.

Why Logarithmic Scale Matters for Bitcoin

Bitcoin’s price has increased from fractions of a penny in 2009 to peaks exceeding $126,000 in 2025—a gain of millions of percent. On a standard linear chart, early price movements would be invisible, compressed into a flat line at the bottom. The logarithmic scale used in the bitcoin rainbow chart solves this problem by giving proportional visual weight to percentage changes rather than absolute dollar amounts.

A 100% gain (doubling) from $100 to $200 occupies the same vertical distance on a logarithmic bitcoin rainbow chart as a doubling from $50,000 to $100,000. This makes the chart ideal for analyzing Bitcoin’s behavior across its entire history, capturing patterns that would otherwise be obscured by its explosive growth trajectory.

The Rainbow Bands: Interpreting the Colors

The colored bands overlaying the bitcoin rainbow chart represent different market sentiment zones based on Bitcoin’s position relative to its historical growth curve. While various versions of the chart exist with slight variations, the standard bitcoin rainbow chart typically features eight to nine color bands:

Bottom Bands (Accumulation Zone):

- Dark Blue – “Fire Sale” / “Basically a Fire Sale”: Bitcoin is severely undervalued and historically represents an exceptional buying opportunity. Prices in this zone have occurred during major capitulation events and bear market bottoms.

- Blue – “BUY!”: Still undervalued, representing attractive entry points for long-term investors.

- Light Blue – “Accumulate”: Below fair value, suggesting continued accumulation makes sense.

Middle Bands (Fair Value Zone):

- Green – “Still Cheap”: Approaching fair value but still below historical averages, representing reasonable entry points.

- Yellow – “HODL!”: Fair value territory where Bitcoin trades most frequently. The classic “hold on for dear life” zone, where patience typically rewards investors.

Top Bands (Caution/Euphoria Zone):

- Light Orange – “Is This a Bubble?”: Bitcoin is entering potentially overvalued territory, warranting increased caution.

- Orange – “FOMO Intensifies”: Fear of missing out drives prices higher, signaling elevated risk and potential profit-taking opportunities.

- Red – “Sell. Seriously, SELL!”: Historically overvalued territory where previous market cycle tops have occurred.

- Dark Red – “Maximum Bubble Territory”: Extreme overvaluation, suggesting unsustainable prices and imminent corrections.

The color bands follow a logarithmic regression, but are otherwise completely arbitrary and without any scientific basis. The specific color boundaries were chosen subjectively to create meaningful zones, not through rigorous statistical analysis.

Bitcoin Rainbow Chart Limitations and Criticisms

The Past Performance Paradox

The most fundamental limitation of the bitcoin rainbow chart is that it’s entirely based on historical data. While past patterns provide context, they offer no guarantee of future repetition. Bitcoin’s market structure has evolved dramatically—from a niche experiment traded by cryptography enthusiasts to a globally recognized asset held by sovereign nations, publicly traded companies, and major institutional investors.

This maturation process may fundamentally alter Bitcoin’s price behavior. As with any kind of financial asset, past prices cannot predict future price movements. The bitcoin rainbow chart could suddenly lose predictive power if Bitcoin’s growth trajectory shifts from its historical logarithmic pattern to a different curve as the market matures.

Subjective Color Boundaries

Perhaps the most overlooked criticism is that the bitcoin rainbow chart’s specific color boundaries are arbitrary. While the logarithmic regression curve is mathematically derived, the decisions about where to draw lines between “HODL!” and “Is This a Bubble?” or between “Accumulate” and “Still Cheap” reflect subjective judgment rather than rigorous statistical analysis.

Different versions of the bitcoin rainbow chart use different band spacings and color schemes, leading to varying signals. An investor following one version might see a “buy” signal, while another version suggests holding. This subjectivity means the chart should complement, not replace, comprehensive investment analysis.

How to Access the Bitcoin Rainbow Chart

Several websites maintain real-time, interactive versions of the bitcoin rainbow chart:

Blockchaincenter.net: The original and most popular version created in 2014, featuring the classic rainbow design and regularly updated price data.

Bitbo Charts: Offers multiple rainbow chart variants including the Halving Price Regression version, Power Law Rainbow, and Stock-to-Flow Rainbow, allowing comparison between different methodologies.

CoinGlass: Provides a professional-grade Bitcoin rainbow chart with additional technical indicators and customization options suitable for serious traders.

Bitcoin Magazine Pro: Features a live Bitcoin rainbow chart integrated with broader market analysis and institutional-grade research.

The bitcoin rainbow chart’s greatest strength lies not in precise price prediction—a task no tool can reliably accomplish—but in providing psychological anchoring and relative valuation context.

During bear market capitulation when fear dominates and Bitcoin seems destined for zero, the blue bands remind investors that similar price levels previously represented generational buying opportunities. During euphoric bull markets when Bitcoin’s rise seems limitless and FOMO drives irrational behavior, the red bands inject necessary caution and historical perspective.

For the sophisticated investor, the bitcoin rainbow chart serves as one input among many in a comprehensive analytical framework. It complements technical analysis, on-chain metrics, fundamental research, and macroeconomic context rather than replacing them.

Used appropriately—as a relative valuation guide encouraging patient accumulation during despair and prudent profit-taking during euphoria—the chart embodies timeless investment wisdom: buy low, sell high.