As of July 2025, bitcoin continues to change the global financial landscape, with retail investors leading the demand through spot Bitcoin Exchange-Traded Funds (ETFs), while the corporate Bitcoin treasury strategy faces increasing questions about its sustainability.

Retail Investors Drive Bitcoin ETF Surge to New Heights

Retail investor interest for bitcoin remains strong, with spot ETFs becoming a preferred investment option. A recent report reveals that almost 75% of spot Bitcoin ETF shares are held directly or indirectly by retail investors with a total market value of nearly $136 billion.

Since their launch in January 2024, these ETFs have eased access for investors who were concerned about direct custody, amassing approximately 1,250,000 BTC, priced at around $109,000 per BTC.

Investment advisers manage almost half of the $21 billion in assets reported through 13F filings, while hedge funds, including institutions like Goldman Sachs and Millennium Management, manage approximately $8.8 billion, worth approximately 83,934 BTC at current market rates of $108,210 as of July 5, 2025.

BlackRock’s iShares Bitcoin Trust (IBIT), with over $72.4 billion in assets, has surpassed its S&P 500 ETF (IVV) in terms of revenue, a testament to the increase in retail and institutional interest.

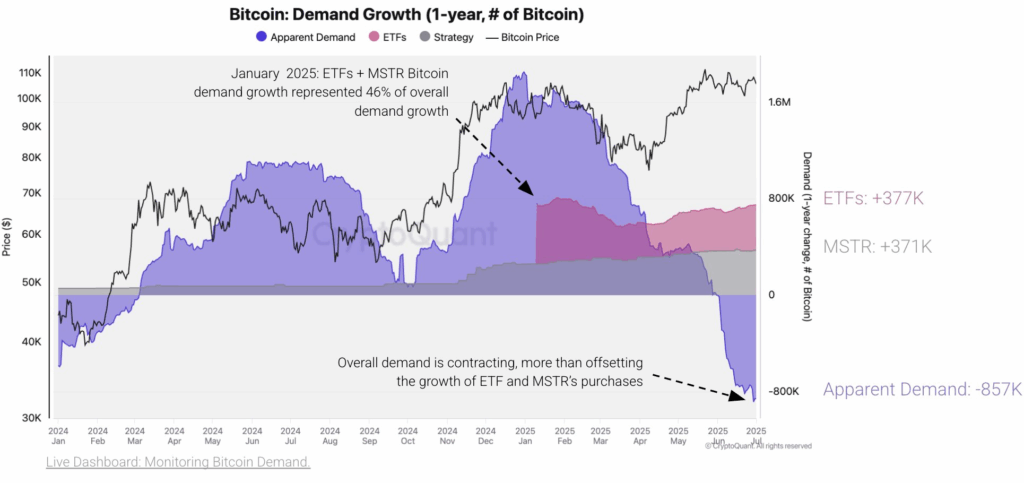

However, according to CryptoQuant data, the demand for bitcoin is reducing, declining to -857,000 BTC from a high of approximately 377,000 BTC bought by ETFs in January 2025, proof of price stabilization between $105,000 and $110,000.

In regions like Nigeria and Argentina, retail investors opt for direct buying of bitcoin and self-custody due to limited financial infrastructure. Analysts predict that interest rate cuts could trigger immediate demand, boosting both ETF inflows and market sentiment.

Is Corporate Bitcoin Bet a Bold Move or a Risky Gamble?

The corporate bitcoin treasury strategy, led by companies like Strategy, is under intense scrutiny due to its long-term viability.

A Forbes analysis suggests that most companies that adopt these strategies do so with diminishing core business performance and with bitcoin volatility risks, which can generate spectacular drawdowns impacting operations and stock prices.

Strategies like issuing at-the-market (ATM) shares or debt during bear markets risk a “death spiral” of lost investor confidence and forced bitcoin sales. Competition increases with companies like Metaplanet and Nakamoto, which raised $710 million for a SPAC, potentially diluting opportunities for newcomers.

Regulatory and operational issues bring additional complexity. Public companies must comply with strict disclosure requirements, while private companies struggle with limited access to scalable debt.

Custody risks, reliance on trusted custodians, and counterparty failures in lending or trading make the strategy even more complex. The European Union’s MiCA regulation, fully enforced since December 2024, imposes additional compliance burdens.

While some experts warn of a “far shorter lifespan” for this approach, others support its role as an inflation hedge.

Retail Confidence vs. Corporate Caution

The difference in dynamics of retail ETF demand and the corporate treasury approach shows Bitcoin’s growing role in finance. With approximately $136.25 billion in ETF assets, retail investors show strong faith in Bitcoin’s long-term potential, driven by ETF accessibility.

Conversely, the dependence of the treasury approach on fresh capital from investors is alarming, with Bitcoin Magazine describing it as a Ponzi-like structure that remains vulnerable to collapses during bear markets.

Galaxy Research is seeing treasury companies trading at premiums over their net asset value, proof of optimism but also risk of leverage.

Despite these concerns, advocates see the treasury strategy as a hedge against inflation, citing institutional adoption, such as El Salvador’s holdings of over 6,000 BTC. With increasing competition and cycles of the market, the future of the approach depends on companies’ ability to navigate volatility and regulations.