The Lightning Network, a crucial scaling solution for bitcoin, has seen a staggering 122% increase in lightning network transactions over the past two years. This is according to a new report by River, a U.S.-based bitcoin brokerage.

Sam, a bitcoin research analyst at River, presented these findings at a recent bitcoin conference in Amsterdam, emphasizing the network’s growing importance in facilitating low-value transactions that traditional on-chain methods struggle to support.

The report indicates that as of August 2023, the Lightning Network processed approximately 6.6 million routed transactions, a significant jump from just 500,000 transactions reported in August 2021. This surge highlights the network’s capability to handle small payments efficiently, addressing previous criticisms regarding its utility and capacity.

Sam pointed out that while critics often focus on the total bitcoin capacity of the network—currently around 5,000 bitcoin—it is the effective use of this capacity that truly matters.

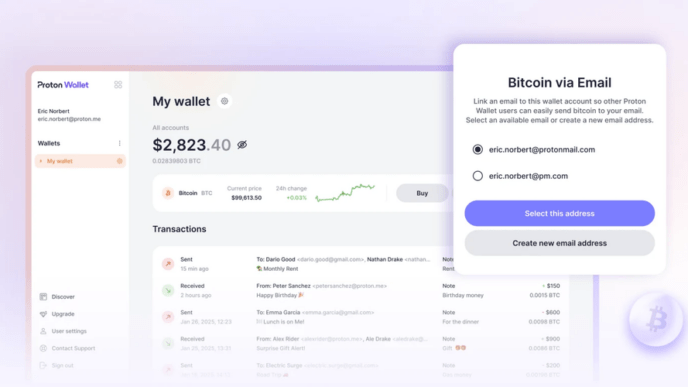

River has been integrating with the Lightning Network since its inception in 2019 and has developed an API called River Lightning to assist companies in leveraging this technology. The first major client was El Salvador’s Cho wallet, which gained attention when bitcoin was made legal tender in the country. This partnership underscores River’s commitment to advancing Lightning Network adoption.

Table of Contents

Understanding the Lightning Network

To appreciate the significance of these lightning network transactions findings; it is essential to understand why the Lightning Network was created. In its early years, bitcoin was marketed as a solution for cheap online payments. However, as transaction volumes increased, it became evident that on-chain transactions could not scale effectively without incurring high fees.

Sam explained that as of 2022, users needed to send about $150 in a bitcoin transaction to maintain a reasonable fee percentage. As a result, many low-value payments became economically unfeasible on-chain.

The Lightning Network emerged in 2016 as a solution to this problem by allowing users to conduct transactions off-chain while still benefiting from bitcoin’s security features. It enables users to establish payment channels with one another, facilitating rapid transactions without recording every single payment on the blockchain. This method not only reduces congestion but also preserves decentralization by allowing users to transact without relying solely on large nodes.

Lightning Network Transactions Dynamics

According to River’s data from its Lightning nodes, nearly 50% of transactions involve low-value payments ranging from one to one thousand satoshis. This shift demonstrates how the Lightning Network extends bitcoin’s capabilities by enabling users to conduct small transactions that would otherwise be impractical.

The underlying mechanics of the Lightning Network involve setting up financial relationships between parties through payment channels. When two users establish a channel, their nodes keep track of how much value each party controls within that channel. This allows for numerous transactions between them without needing to record each one on-chain. Instead, only the final balance is settled on-chain when they choose to close the channel.

Addressing Criticism

Despite its growth and utility, the Lightning Network has faced skepticism from some critics who argue that its capacity remains too low compared to bitcoin’s total supply of 21 million coins.

They often cite the relatively small amount of bitcoin currently held within the network as evidence of its failure. However, Sam argues that it is crucial to consider how effectively this capacity is being utilized rather than merely focusing on raw numbers.

The report reveals that while there has been a drop in bitcoin’s market price—the activity within the Lightning Network has continued to expand. Sam emphasized that it is primarily existing users who are driving this growth rather than new entrants into the space.

Key Findings

The report outlines several key findings regarding transaction activity and user engagement:

- The 122% increase in activity over two years represents a robust growth trajectory for the Lightning Network.

- The estimated 6.6 million routed transactions as of August 2023 highlight significant user engagement.

- Nearly half of all transactions involve low-value payments, showcasing the network’s utility for everyday microtransactions.

- The growth of private channels and nodes complicates efforts to measure overall activity accurately; thus, current estimates may represent only a lower bound.

Sam noted that earlier estimates from Arcane Research indicated only 500,000 transactions in August 2021; however, improved data collection methods and increased participation have led to more accurate assessments of network activity today.

Future Prospects

As businesses and individuals continue adopting the Lightning Network for various use cases—from micropayments for digital content to facilitating cross-border transactions—the potential for further growth remains high. River’s commitment to enhancing integration through its API will likely play a pivotal role in expanding adoption among merchants and consumers alike.

The report of the number of Lightning Network transactions paints an optimistic picture of the network’s evolution and its capacity to enhance bitcoin’s functionality as a medium for everyday transactions. As more businesses and users adopt this technology, it is poised to play an increasingly vital role within the bitcoin ecosystem.

With ongoing developments and enhancements within the Lightning Network infrastructure and user experience, stakeholders are eager to see how this technology will shape the future landscape of digital payments and bitcoin adoption overall. As Sam aptly summarized during his presentation: “The Lightning Network is not just about scaling; it’s about unlocking new possibilities for bitcoin.”