In the heart of East Africa, where M-Pesa reigns supreme and innovation pulses through bustling markets, a quiet revolution is brewing—one that could redefine how millions interact with money.

Enter Bitika, the Kenyan startup turning bitcoin’s complexity into a three-step dance, merging the lightning speed of sats with the trusted rhythm of mobile money.

At the helm is a founder whose “aha” moment came not in a boardroom, but at his kitchen table, watching his father grapple with the gap between understanding bitcoin and actually using it.

Bitika was born from that friction—a bridge between M-Pesa’s ubiquity and bitcoin’s borderless promise, wrapped in a name as playful as the Swahili slang that inspired it.

But this isn’t just a story about simplifying transactions. It’s about liquidity battles, regulatory tightropes, and a vision to turn Bitika into the invisible rails powering Africa’s Bitcoin future.

Building on Bitcoin

- Tell us a bit about yourself and how you got into bitcoin/fintech, and what keeps you passionate about this space?

I first came across bitcoin in 2020, but like many at that time, I didn’t fully grasp what it really was. It sounded too complicated, probably with the heavy terminologies. Over time, I kept digging deeper and became more curious.

I started digging into finance and how money works and realised this was what I needed to understand bitcoin’s objectives. I realized that bitcoin wasn’t just a new type of money—it was a breakthrough in how we think about freedom, ownership, and global finance.

What keeps me passionate is how bitcoin can empower people—especially in Africa—to take control of their wealth, without relying on unstable systems or middlemen.

- What pivotal moment or experience inspired you to create Bitika? Was there a specific gap in Kenya’s financial ecosystem that sparked the idea?

Yes, this idea was actually born right in my own home. I’ve always been an advocate for bitcoin, sharing it with friends, family, and even strangers. My dad and I had countless conversations about it. Eventually, he understood the concept. But when he asked, “How do I even buy bitcoin?” or “Can you just buy it for me?” and after taking him through binance—that hit me.

If someone I’d educated still found the buying process difficult, how many others were feeling the same way? That was the lightbulb moment. I saw a clear gap: the process of buying bitcoin was too technical for the average Kenyan. That’s the problem Bitika set out to solve.

- How did you identify the synergy between bitcoin and M-Pesa as a solution for accessibility?

M-Pesa is at the center of daily life in Kenya. Everyone uses it—from buying groceries to paying rent. Instead of forcing people to learn new tools, I decided to meet them where they already are. That synergy between M-Pesa and bitcoin felt natural. It’s about bridging what people already trust with something powerful and new.

- Share the story behind the name “Bitika” – does it hold a cultural or symbolic meaning?

Funny enough, Bitika isn’t a deeply planned name. It came while I was thinking about bitcoin and the type of transformation it brings to individuals. In Swahili, we often add “-ka” to words for flair—like “bambika” from “bamba.”

So, I just coined Bitika as a playful and catchy way to reflect something bitcoin-related, but also uniquely local. I stuck with it because thinking of an ideal brand name is the toughest challenge for me.

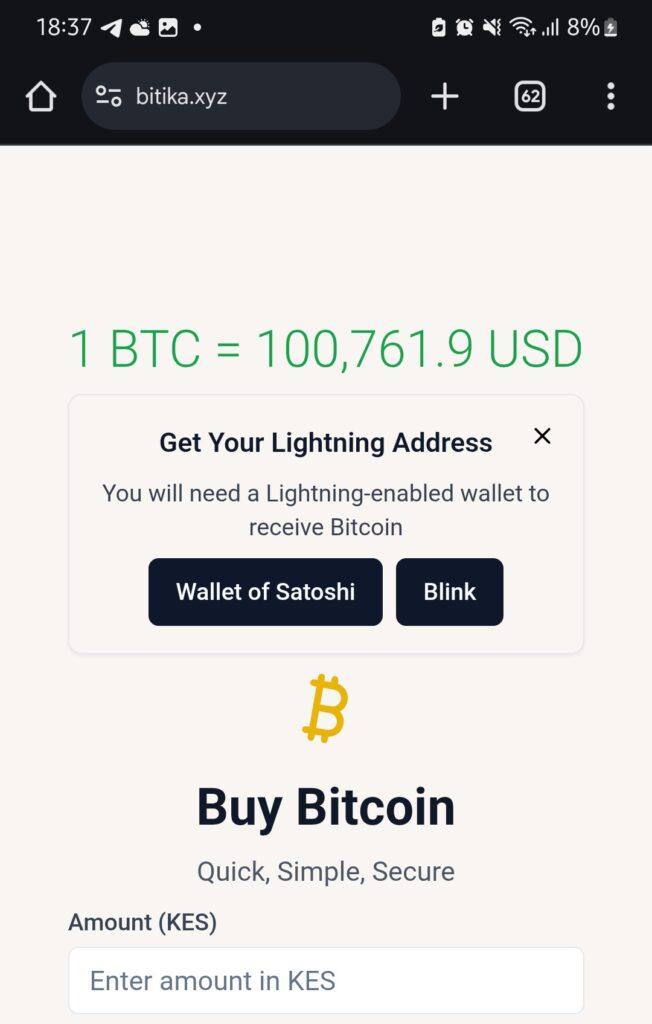

- Walk us through the user journey – how does buying bitcoin via M-Pesa in “3 simple steps” work under the hood?

It’s beautifully simple.

1. The user enters the amount they want to spend in KES—starting from as little as 50 KES (about $0.30).

2. They input their Lightning wallet address.

3. They enter their M-Pesa number, which triggers an STK push (payment prompt) on their phone. Once confirmed—pap!—they receive bitcoin almost instantly.

Under the hood, we fetch the live BTC price, validate wallet addresses, check available liquidity, process the mobile payment, and send sats via the Lightning Network—all streamlined into a smooth experience for the user.

- Who’s Bitika’s primary audience? Are you focusing on unbanked populations, tech enthusiasts, or both?

Both. Bitika is designed for everyday people—especially the unbanked and underbanked who are excluded from traditional finance. But we also attract bitcoiners who just want a faster, easier way to buy sats. What unites them is the desire for a seamless and low-barrier bitcoin experience.

Community and Overcoming Challenges

- What challenges has Bitika faced navigating Kenya’s bitcoin regulations, and how do you build trust with regulators?

Regulation is still evolving here. Parliament has drafted bills, but none have been passed into law yet. We’re currently in a revision phase where policymakers are trying to strike a balance between encouraging innovation and protecting the public.

We focus on transparency and open dialogue—we believe that building trust with regulators starts with showing how bitcoin can serve the public good.

- What was the toughest obstacle in building Bitika, and how did you overcome it?

Liquidity. Since we don’t have deep capital reserves, we often run into situations where we have to pause operations often to manually restock our bitcoin supply. It’s frustrating—for us and for users. We’re working on automating this process and securing funding to maintain consistent liquidity so users can access bitcoin at any time, without disruption.

This remains our most critical issue—and the primary reason we’re seeking support.

- Are you eyeing new African markets? What’s next for Bitika’s product?

Absolutely. The long-term vision is to expand Bitika into other African countries facing similar financial challenges. But first, we want to turn Bitika into a developer-first tool—infrastructure that others can build on. Imagine local apps, savings products, or financial tools built using Bitika’s simple bitcoin rails. That’s where we’re heading.

- What would you tell other African entrepreneurs aiming to disrupt traditional finance?

Disrupting finance sounds exciting—but the reality is messy. People fear what they don’t understand. That’s why simplicity is everything. Build tools that hide the complexity, and focus on making the user’s life easier. Most importantly, stay rooted in local context—solve problems people actually face.

What’s Next?

- What’s your message to Kenyans hesitant to try bitcoin, and to enthusiasts watching Bitika?

To my fellow Kenyans: bitcoin isn’t just an investment—it’s a sovereign tool. It’s money you truly own. Start small, learn, and ask questions.

To the bitcoin community: Bitika is proof that bitcoin is working in Africa. Let’s keep pushing. Let’s build tools that matter.

- How can the bitcoin community, both locally and globally, support Bitika’s mission?

We’re currently fundraising on Geyser. Support—whether it’s financial, technical, or simply sharing our story—goes a long way. Every sat you contribute helps us stay live, grow our liquidity, and continue building a tool that brings bitcoin closer to the everyday person in Africa.

Support here: https://geyser.fund/project/bitika