In 2025, bitcoin merchant adoption is still a niche phenomenon. A new initiative called The Bitcoin Merchant Community (BMC), now wants to accelerate adoption with a creative approach.

The mission is clear and simple; “The Bitcoin Merchant Community is a growing global community of small businesses helping one another defeat 3% credit card fees by accepting bitcoin.”

The Bitcoin Merchant Community is a growing global community of small businesses helping one another defeat 3% credit card fees by accepting bitcoin.

The initiative is supported by Block’s Spiral division, which funds open-source bitcoin tools and promotes bitcoin adoption globally. While Block also owns Square, the BMC seems open to other bitcoin payment solutions such as blink, BTCPay Server or Manna.

On a recent blog post, BMC explains what makes the movement unique:

“Bitcoin advocacy has been, up to this point, very online. It makes sense: bitcoin is online, and online is where we all sort of live now. But for every level-headed and persuasive pro-bitcoin post that makes it into a non-bitcoiner’s feed, there are 999 posts above and below attempting to suffocate it. Everything gets diluted online. Occasionally, something will break through and register with someone, only to be forgotten about five minutes later.

Because of this, we realized that thoughtful, focused in-person advocacy must play a central role in promoting bitcoin and the Bitcoin Merchant Community, advocacy that we think should come in two forms: regular in-person and weird in-person.

Realistically, a customer showing up in person to talk about how bitcoin solves the problem of 3% fees? Memorable, definitely, though maybe a little ehhh. But a customer showing up in person with two impossible-to-ignore, straight-to-the-trash-resistant leave-behinds and a powerful, focused argument? Especially if that leave-behind is bright orange, cuddly, and just as grumpy about 3% credit card fees as merchants are? A leave-behind that can be used at the register by merchants to tell patrons that, “yes, we accept bitcoin”? Say what you will about the messenger, but they won’t be forgetting the message, especially when they learn that thousands of others like them got the same one.”

If you’re interested to join or support the initiative – or if you feel a subconscious urge to get your hands on a bitcoin plushie – you can apply on the BMCs website as a collaborator and receive a package to help you onboard merchants in your hood.

The hidden cost of credit cards for small business

According to Mercury’s guide on credit card fees and an analysis by Republic Bank, for many small businesses, profit margins hover around 6%, yet credit card fees routinely take a 3% chunk or more of every transaction. The math is merciless, when half the profit on sales would disappear to payment processors.

This cost forces businesses to either raise prices or watch their earnings shrink—an unsustainable squeeze as cash use declines globally

Bitcoin payments: significantly lower fees, instantly settled

Bitcoin payment fees currently range between 0.4% and 1%, a steep contrast to credit card fees which commonly exceed 2% and can reach 3.5% or more with some gateways. The speed, reduced cost, and worldwide borderless nature of bitcoin payments provide clear advantages for merchants, especially when layered solutions like Lightning drastically reduce network fees.

Square’s breakthrough: over 4 million merchants adopting bitcoin payments effortlessly

Block, Inc.’s Square has integrated bitcoin payments into its ecosystem, enabling 4 million merchants in the U.S. to accept bitcoin with zero fees until 2027. This integration leverages the Lightning Network to settle transactions in seconds and gives merchants a straightforward, low-cost alternative to credit cards. Small businesses can switch on bitcoin payments with a few clicks on their square dashboard.

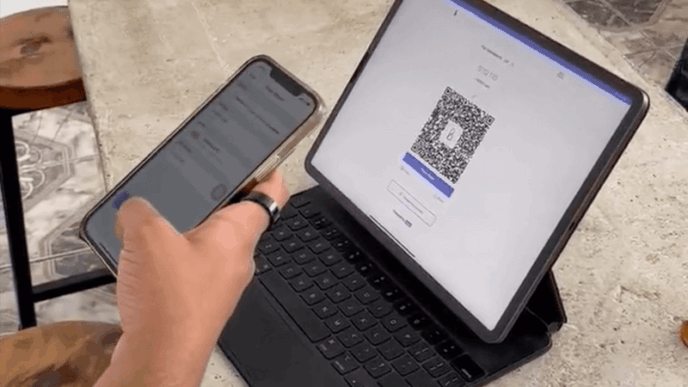

But who will pay in bitcoin? What’s interesting here is that CashApp, also a Block Inc subsidiary, has also enabled bitcoin lightning payments. Users don’t need to own bitcoin in CashApp but can spend over lightning using their dollar balance. This means the app can be used for low-cost payments on an open protocol anywhere in the world. For local merchants it means they can tremendously reduce payment costs or forward it to customers with incentives.

Community trust and grassroots advocacy

But beyond tech, it’s the peer-to-peer trust and community advocacy that fuels real change. The Bitcoin Merchant Community runs a thriving Facebook Group where merchants share tips and firsthand stories—evidence that bitcoin can save money and simplify operations. More compellingly, BMC distributes free kits complete with bright orange leave-behinds and even cuddly plushie mascots through local hubs like Presidio Bitcoin and Bitcoin Park, making in-person outreach memorable and effective. This grassroots work brings bitcoin acceptance to local businesses where it matters.

Listing on BTC Map connects bitcoin-accepting merchants to consumers looking to spend, closing the loop by enhancing bitcoin’s use as spendable money rather than just an investment—an essential shift for widespread adoption. And the momentum is clear: in 2025 alone, more than 40% of merchants who accept crypto chose bitcoin, with over 640,000 crypto payments recorded in the first half of the year, a 55% growth over prior year figures. Projections indicate over an 80% growth in crypto payments in the U.S. market through 2026, underscoring a massive untapped opportunity for merchants and consumers alike.

Bitcoin’s rise as everyday money is no longer a fringe notion but an unfolding mainstream shift, led by communities like BMC whose mission is to fight back against exorbitant processing fees and reclaim a fairer, digital cash economy for small businesses everywhere. This is where practicality meets innovation, and merchants finally get to keep what they earn. Good for small businesses but also good for consumers.