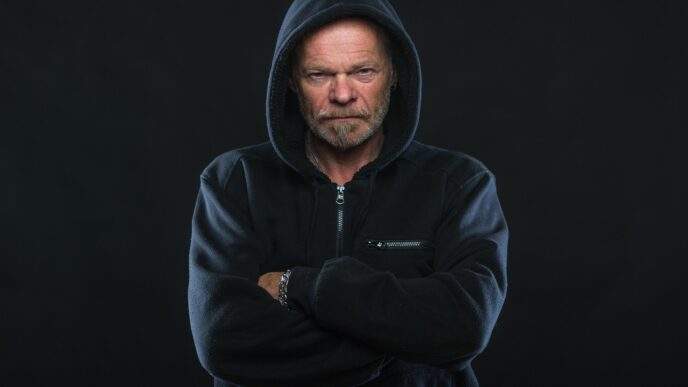

Interview with Andreas Streb, CEO VR Bayern-Mitte

Banks and financial institutions are not known as pioneers of Bitcoin adoption. But now they are coming — unstoppable — and a German cooperative bank is taking big steps. Andreas Streb is the Managing Director of Volksbank Raiffeisenbank Bayern Mitte eG, which is also the organizer of the Bitcoin Forum Bayern. In this interview, he provides exciting insights into the bank’s strategic direction, as well as the potentials and challenges for banks.

LightningNews: You’re hosting the Bitcoin Forum in Ingolstadt already in its third edition — what motivated you to organize a Bitcoin conference?

Streb: Education. We simply wanted to shed light on the topic for the public — to explain “what is Bitcoin” through workshops, lectures, and so on. That was the basic idea, and that’s how the first Bitcoin Forum was born, which then grew over two, two and a half years.

Back then, we set it up together with the THI — the Technical University of Ingolstadt. We wanted to examine the topic of Bitcoin as a bank and a university — something that had suddenly appeared — to show that there are also normal people dealing with it. That’s how it started back then, and already in the first year it turned out bigger than planned.

There were professional lectures, but the idea was always to make Bitcoin understandable for beginners. In the first year, the focus was on content for newcomers; in the second, it became more difficult, because we noticed that of course many Bitcoiners also came. And then you can’t just have a talk on “What is Bitcoin” again — you need something new.

Today, the challenge is that we need the right level for all audiences: I need beginner lectures, but also something deeper. The background, as I said, remains the same — and this year in particular, it was very important for us not to attract Bitcoiners, because we want the broader public to gain a different impression of the topic.

There are still so many misconceptions, so many negative opinions — and this is where education can help. That’s the purpose of the Bitcoin Forum.

LightningNews: As Bitcoiners, we all know JP Morgan and Jamie Dimon, who only a few years ago said “Bitcoin, an overhyped fraud” — and now they offer Bitcoin services. How do you see the development among banks, institutions, and also yourself? What’s the path from skeptic to convinced Bitcoiner?

Streb: Ten years ago, if someone asked me “Bitcoin — is that something?”, I’d say: no, stay away from it. Clearly — no idea about it, but an opinion nonetheless. For me, that changed about five years ago when I started looking into it. I thought, “Okay, that’s an interesting topic where we, as an institution and a bank, can accompany our customers.”

Looking back over those five years, seeing how it has developed — how more and more institutions and topics like regulation, ETF approval, and so on are becoming part of the mainstream financial world — anyone who still thinks this topic is unimportant or a scam has simply never looked into it.

“Anyone who still thinks this topic is unimportant has simply never looked into it.”

This is a topic where banks can also engage with customers on new fronts — asset allocation, further development, energy — suddenly new themes arise. And then there are companies interested in these areas, or in payments — Lightning, of course — where we can say: yes, there are solutions, and that’s our field. We set up payment terminals in businesses; maybe in a year, we’ll be supporting other banks with Lightning terminals.

The development has been positive and will continue.

LightningNews: Banks have areas like savings, loans, payments. Where do you see the greatest potential — do you have a focus?

Streb: We’re focusing on offering Bitcoin as a diversification option in asset allocation — in other words, as an investment option where the customer says, “I’d like to add this as a component.” Then we have our trading platform, and that’s our main revenue direction.

We view topics like mining and payments very positively. If we have companies — for example, I spoke yesterday with someone who runs a small business and wants to accept Bitcoin payments — we say: great, go for it! Once they’ve implemented it, we promote it and look for partnerships.

We’re not doing this for fun or out of hobby — we are a commercial enterprise. So we must keep an eye on cost and benefit.

It’s the same with mining: we try to establish partnerships; experts analyze energy concepts, and maybe as a bank we have the opportunity to co-finance. If we understand mining, we can also finance the equipment.

These are the three areas where there will definitely be potential in the coming years — and where a bank can benefit.

LightningNews: What’s your experience with industry colleagues when you talk about mining financing?

Streb: You have to start from scratch. You can’t explain the topic in five minutes. The danger is that if you’re as enthusiastic as I am, you go deeper and deeper into detail. It’s hard to find the right dose. What’s important is to spark interest in the first conversation, so that the other person continues looking into it on their own.

Sometimes that works in banks; some employees get excited, but the board level isn’t there yet.

I don’t chase anyone anymore — if someone wants to, we’ll support them. Otherwise, it’s a pity to waste the time.

LightningNews: We had a presentation from Leon Wankum showing how quickly the market for various Bitcoin-based investment products has grown. How do you see the future there — are you involved in such developments?

Streb: We ourselves are institutional investors — we invest in the capital market and have Bitcoin as a diversification element in our strategy. The only question is through which vehicle. We can buy securities — not Bitcoin directly, but shares, yes. I observe it and think it’s a positive development.

The idea that [Michael Saylor] has — to build a company that structures products so that everyone can choose what fits them, and thereby participate in Bitcoin without holding it directly — I like that.

What’s difficult right now is the mere imitation across the industry, just because someone has Bitcoin on the balance sheet. Sure, it can work, but I’d find that difficult personally. As I said, with a strategy, I can see it working well — but otherwise, I’m hesitant. In general, though, I think that’s the next step to bring Bitcoin into institutions.

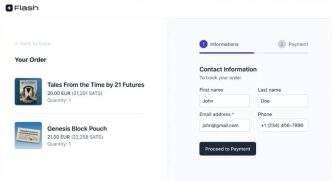

LightningNews: You’re also working with young companies like 21bitcoin — how did that come about?

Streb: Yes, that’s actually not our business model at all — investing in fintechs and startups. The cooperation with 21bitcoin came out of a fair in Innsbruck, where a company was looking for a bank. We got involved because we were convinced that there was potential if the app worked and scaled.

What’s exciting is that the market is still so new, but it can develop very quickly. So it’s important to get involved at a time when the company is still small — and that’s what we did. Essentially, we took on the risk and dared to do something.

We were also able to convince our committees to the point that we can now pursue a two-track Bitcoin strategy. As a regional bank, we never aimed to sell Bitcoin across Germany. With other regional banks, there’s always a regional focus — but with 21bitcoin, we now have an investment that extends beyond our region and serves the entire European market.

So far, this strategy has worked out well. The company is developing excellently — they are now about to receive their MiCAR license in Austria, which will allow them to expand into other European countries accordingly.

LightningNews: How do you deal with regulation in the area of Bitcoin — is that a challenge?

Streb: Yes. The problem is that the regulation that now exists is crypto regulation and concerns cryptocurrencies in general. But Bitcoin actually can’t be regulated — Bitcoin, what exactly would you regulate there? But they’re trying.

It then becomes difficult to cope with the documentation madness that arises from it. The European crypto regulation, for example, applies to the issuance of crypto coins — but what does that have to do with Bitcoin? From my point of view, this regulation completely misses the point when it comes to Bitcoin.

When you do something with Bitcoin [as a bank], you have to comply with the regulatory framework — and we document ourselves to death in order to meet the requirements. It’s a huge challenge.

These rules block us, because we would like to do much more — things that would be good for customers — but we hold back from a regulatory standpoint. Until we have the license and the necessary processes in place, we can’t do anything.

LightningNews: Almost 3,000 participants — more next year?

Streb: When someone comes to the Bitcoin Forum, they already have a basic interest — and that’s enough. We want to spread the topic further.

We’ll decide on next year’s organization after this forum. It costs us resources, time, and effort, so we’ll weigh how to approach the next conference — whether bigger, smaller, or in a different format.

LightningNews: Where do you see Bitcoin in five years?

Streb: More widespread adoption — and many will wonder why they didn’t get into it earlier, just as I did.

LightningNews: Thank you very much.

Streb: My pleasure.