MicroStrategy, now rebranded as Strategy Inc., has become the most extreme case of a bitcoin corporate treasury strategy in global markets. Instead of holding cash or bonds like traditional companies, it has accumulated over 630,000 BTC, valued at more than $70 billion.

This move has transformed its equity into a leveraged bitcoin proxy, making MSTR stock one of the most unique and volatile assets on Wall Street.

Why MicroStrategy’s Bitcoin Treasury Matters

Most corporations keep their treasuries conservative, aiming for stability rather than risk. By contrast, MicroStrategy bet on bitcoin’s scarcity and long-term appreciation as a hedge against inflation and fiat currency debasement. From a strategic perspective, it positioned itself as a hybrid — part technology company, part bitcoin exchange-traded proxy.

For Bitcoin advocates, this approach showcases the asset’s evolution. What was once dismissed as a speculative token has now become the core of a listed company’s balance sheet, signaling a shift in how corporations think about reserves. But the risks are as real as the potential rewards: volatility cuts both ways, and unlike bonds or cash, bitcoin can lose significant value in a short timeframe.

MSTR Stock Under Pressure

Despite the size of its bitcoin holdings, MSTR stock has struggled in recent months. Since peaking in July, it has dropped nearly 28%, sliding toward the $330 level. Several factors contribute to this decline. Valuation extremes have raised concerns, repeated exclusions from the S&P 500 have limited demand, and investor fatigue around the Bitcoin narrative has weighed on sentiment.

This divergence highlights an important lesson: fundamentals and perception don’t always align. A balance sheet with more bitcoin than Apple or Tesla’s cash reserves does not guarantee share price stability.

The Amplified Beta to Bitcoin

One of the defining traits of MicroStrategy’s Bitcoin treasury is its beta greater than one relative to bitcoin. That means MSTR stock doesn’t just follow bitcoin’s moves — it magnifies them. When bitcoin rallies, MSTR surges. But when bitcoin corrects, MSTR falls harder.

This amplification creates both opportunity and risk for investors. For those bullish on bitcoin, MSTR can deliver outsized returns. But for those caught in a downturn, the drawdowns can be even steeper than holding bitcoin directly.

Options Market and Yield Compression

The options market adds another layer of complexity. Products built on MSTR’s volatility, such as covered call ETFs, have seen yields collapse as premiums declined. When volatility spikes, these strategies look extraordinary. But as the market stabilizes, the income stream falls, leaving investors with exposure but less compensation for the risk.

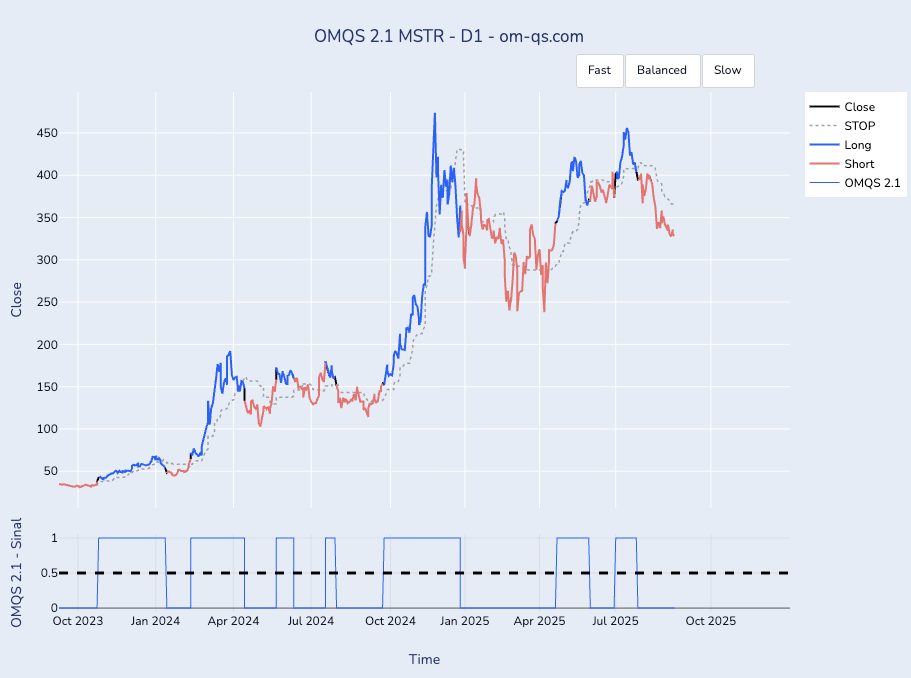

Detecting Regime Shifts

For professional investors, the key is not predicting the next headline but detecting regime shifts in real time. Systematic models that track market structure — such as probability-based regime detection — can help identify when MSTR is in a bullish run versus when momentum has turned.

This type of approach doesn’t eliminate risk, but it provides discipline in a stock where emotional trading can be dangerous.

Conclusion: MSTR is Not Bitcoin Custody

The MicroStrategy Bitcoin treasury represents both a milestone and a warning. It highlights bitcoin’s growing legitimacy as a corporate reserve asset, but it also underlines the risks of concentrating an entire strategy in one volatile asset. For investors, MSTR is not just another equity — it’s a bitcoin treasury strategy packaged as a stock.

And one final point is crucial: buying MSTR is not the same as holding bitcoin. Shareholders remain exposed to corporate risk, equity market sentiment, and balance-sheet decisions made by executives. True sovereignty in bitcoin still comes only through self-custody — holding your own keys, outside the liabilities of companies or intermediaries.