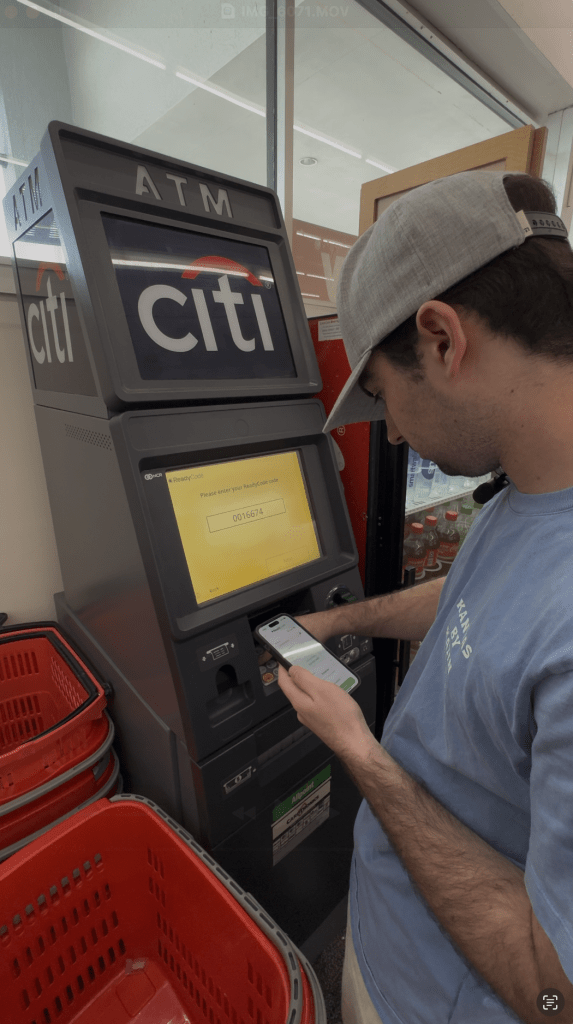

Emilio’s first bitcoin purchase felt like a drug deal – sweating in a parking lot, cash in hand, uncertain if cops would storm in. That visceral distrust of a broken system birthed Unbank: a guerrilla network turning CVS registers into sovereignty hubs.

While banks slammed doors, he retrofitted ATMs with bitcoin hearts, weaponized Lightning against poverty taxes, and built cash-to-bitcoin ramps where the unbanked shop daily. In a post-FTX world screaming ‘self-custody,’ Unbank delivers it with Genmega guts and Voltage veins – because financial inclusion shouldn’t require a passport or pedigree.

Unbank: From Cash to Sovereignty

- You started in 2014 with a single bitcoin ATM in Albany, NY. What personal frustration with traditional finance forced you to bet on bitcoin ATMs? Was there a specific “cash to bitcoin is king” revelation?

There was a moment the very first time I went to buy my first bitcoin, it was a nightmare. At the time, the easiest way for me to buy bitcoin was on Localbitcoins.com which was peer-to-peer transactions in cash, meaning it had to be done face-to-face.

The location where I agreed to meet the guy was in a public area, but while doing the transaction, it just felt dirty, like we were doing something illegal. I knew there would be a market for an easier process to be able for every-day people to buy bitcoin with cash.

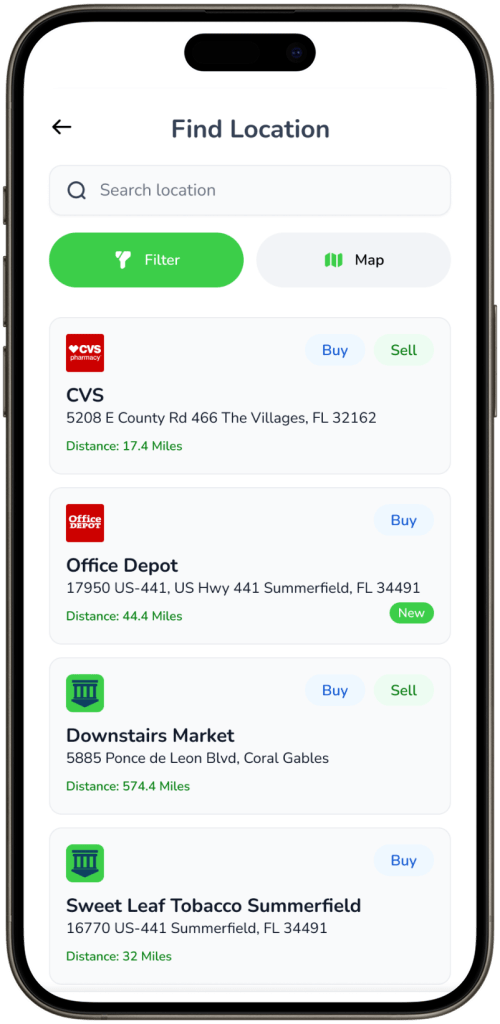

- Early banks rejected you, and merchants feared bitcoin. How did you turn “No” into having services available in CVS, Walgreens, and Office Depot? What convinced these giants?

We were pretty lucky to be honest. While we didn’t partner directly with these brands, we partnered with companies that already have services in these retail stores. That really opened up our ability to bring bitcoin and other top digital currencies to a much wider network.

- Unbank has championed itself as being an easy on ramp for new users. How does prioritizing cash, privacy, and self-custody reflect your vision of true financial inclusion?

Most platforms claim they’re “for the people,” but then require a passport scan and a bank account before you can even get started. That’s not inclusion—that’s gatekeeping, not everyone has access to those. We took a different route: start with cash, lite KYC, and let people hold their keys.

Privacy isn’t just a perk—it’s protection for people in marginalized communities. Self-custody isn’t just a feature—it’s empowerment. By making bitcoin as easy to access as a soda or a bus ticket, we’re turning everyday people into participants in a borderless, censorship-resistant economy. That’s the mission: real freedom in the hands of real people.

ATMs & Beating the Banks

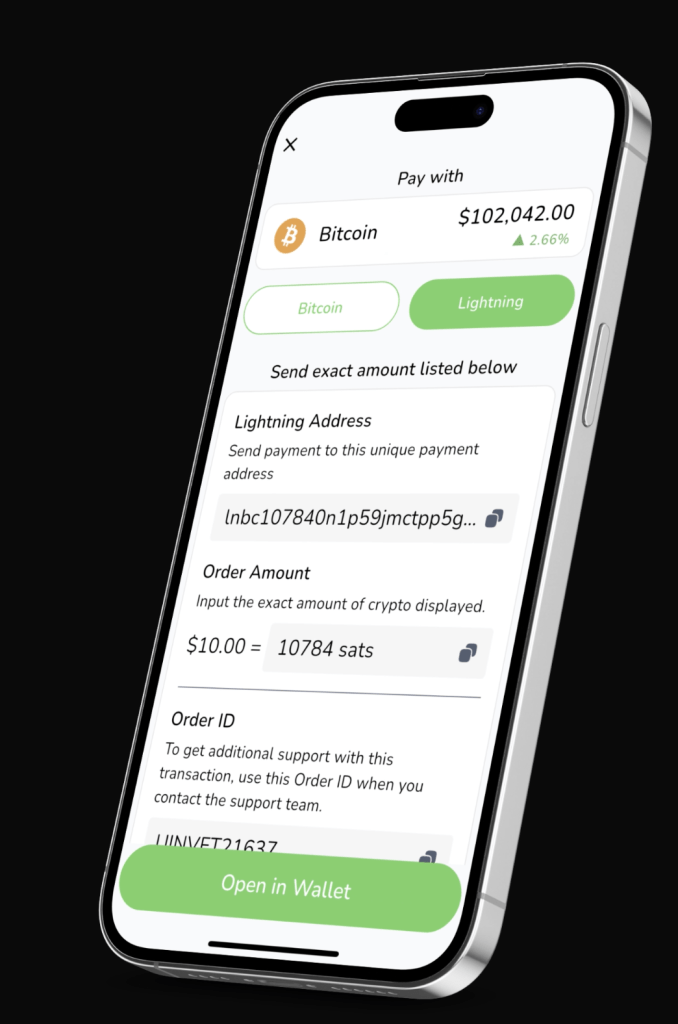

- Your partnership with Voltage powers instant bitcoin buys/sells through the Unbank mobile app. Why was Lightning non-negotiable for scaling? How does slashing fees/time disrupt the “bitcoin is slow” narrative?

People don’t want to wait ten minutes to pay for something. Lightning fixes that. If we were serious about onboarding everyday users, we had to make bitcoin feel instant, like tapping a debit card.

The idea that bitcoin is slow or clunky? That’s legacy thinking. With Lightning, it’s as fast as cash and way more programmable. We knew we couldn’t scale without it—and honestly, we wouldn’t want to.

- Unbank never holds user keys or funds. In a post-FTX world, why is this the right model for mass adoption?

It’s honestly a very simple answer. We care. We care about our users’ well-being and financial longevity, and don’t want to risk their money by holding it hostage. After FTX, Celsius, and BlockFi, anyone still asking customers to “trust us” is missing the point. If we can’t build a business where people hold their own keys, then we’re not building for the future—we’re just repeating the past.

- You’re expanding your fleet together with partner a ATM network for cash-out. How did that accelerate growth? What features do you plan next – NFC taps?

We worked with what was already out there. Partnering with existing networks made it faster and cheaper to scale, especially in cities farther away from our home base- to be able to have technicians and armored carriers be able to work with machines they already know is also another factor.

We don’t many features on our machines, what’s important is that it’s easy to use and we need functionality that works for real users. As for what’s next? We’re watching NFC stuff closely, but it’s gotta serve the user, not just look cool.

Serving the Unbanked: Privacy, Cash & Financial Refugees

- How does accepting physical cash protect marginalized users (e.g., people with less economic and financial means) from surveillance?

Cash doesn’t ask questions. It doesn’t care where you’re from, what your credit score is, or whether you have a bank account account. For countless people, cash is the only tool they trust.

By keeping it in the mix, we give people a way to participate in the digital economy without being tracked, flagged, or denied. It’s about convenience, just as much as about holding consumer rights and protection high. Unlike digital fiat, we believe cash allows people to execute their right to financial privacy – as it should be.

- Unbank offers zero fees on sell transactions. How does this attack the “poverty tax” seen on digital currency exchanges?

We’ve watched it with other exchanges: people getting hit with high fees while trying to use your money. That’s a poverty tax, plain and simple. Our zero-fee sell option was our way of saying, “You’re not less important because you’re moving $20 instead of $2,000.” Everyone should have a way out—and it shouldn’t cost them extra to take it.

Another reason is that we typically see more demand for buying bitcoin than selling so instead of buying back from exchanges we created a win-win, no fees for users to cash-out, no fees for us to buy back what we sold.

- With KYC minimalism, how do you walk the tightrope between regulator demands and Bitcoiners’ right to privacy?

We comply—but we don’t overreach. We collect only what’s necessary by law and nothing more. In my experience, regulators want to prevent crime, not catalog everyone’s life. There’s room to meet the law and still protect user dignity. Our job is to hold that line and keep pushing back on the idea that surveillance is a default. It’s not.

There’s room to meet the law and still protect user dignity. Our job is to hold that line and keep pushing back on the idea that surveillance is a default. It’s not.

Growth & Grit: Scaling Amidst Skepticism

- What tough moment while building a bitcoin centered business in such a volatile market has taught you the most?

There were weeks when we thought we’d have to shut it all down. ATMs would get vandalized, banks would freeze our accounts with no notice, and headlines would scare off merchants and users alike. But those moments teach you to double down on the mission at hand. You realize real change doesn’t happen without resistance. Every “no” we heard made the next “yes” matter even more.

- The Unbank app supports Lightning, has referral codes, and allows you to buy bitcoin with cash at the register or sell bitcoin and withdraw cash from 23,000 ATMs’s without a card. You also support electronic methods for cashout such as PayPal, Venmo, and push to debit card. Why focus on unifying fiat rails instead of digital assets only?

Because people live in fiat—rent, bills, groceries. If we want bitcoin to work for real people, it has to bridge, not replace, their daily life. Building strong fiat off-rails is what makes bitcoin usable, not just holdable. You can’t have financial inclusion if your only audience is digital asset-native. The app is our way of saying, “Bitcoin is ready for the world. Let’s meet it there.”

Future of Finance: Bitcoin, Borders & Beyond

- With rising inflation, could Unbank’s network become a Plan B for financial refugees (e.g., Argentina, Lebanon)?

It already is for some. When your bank account gets frozen or your currency loses half its value overnight, Bitcoin stops being speculative—it becomes survival. Our network, especially the cash-to-crypto infrastructure, gives people a path that doesn’t rely on broken institutions. That’s what makes it powerful. It’s borderless and bankless. While this might only apply to those people in the US right now, we are looking to expand internationally and are currently working on that closely with our development team.

- If Unbank wins, what does the financial system look like? Will cash coexist with bitcoin?

Absolutely. Cash and bitcoin aren’t enemies—they’re allies. Both are permissionless, both protect privacy, and both give people control. Our vision isn’t to kill cash. It’s to elevate choice. In 2030, if Unbank wins, people won’t think twice about using bitcoin at checkout or using cash to top up their wallet. Finance won’t feel like a system anymore. It’ll feel like freedom.

- How can the interested people support Unbank’s mission?

There are many ways our friends across the globe can help! If the Unbank mobile app is available in your region, download and use the app, that would be the number one way.

But there are other ways, too! You can interact with us across a majority of social media platforms such as Instagram, X, Nostr, YouTube, Telegram, and pretty much everything else so a like, subscribe, follow, or share always helps.

And finally, talk to your friends and family about bitcoin and other digital currencies. Having those talks and discussions really helps to educate and encourage others to take a hold of their financial futures, and lends to an overall higher acceptance of digital assets amongst the population.