Metaplanet, a Japanese public company, has been aggressively adopting a bitcoin treasury strategy, positioning itself as a leader in Asia and one of the top global corporate holders of bitcoin.

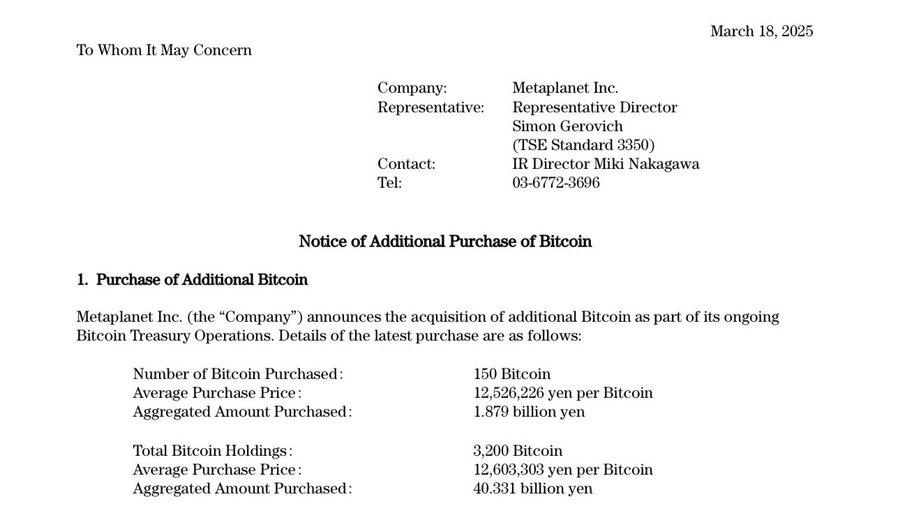

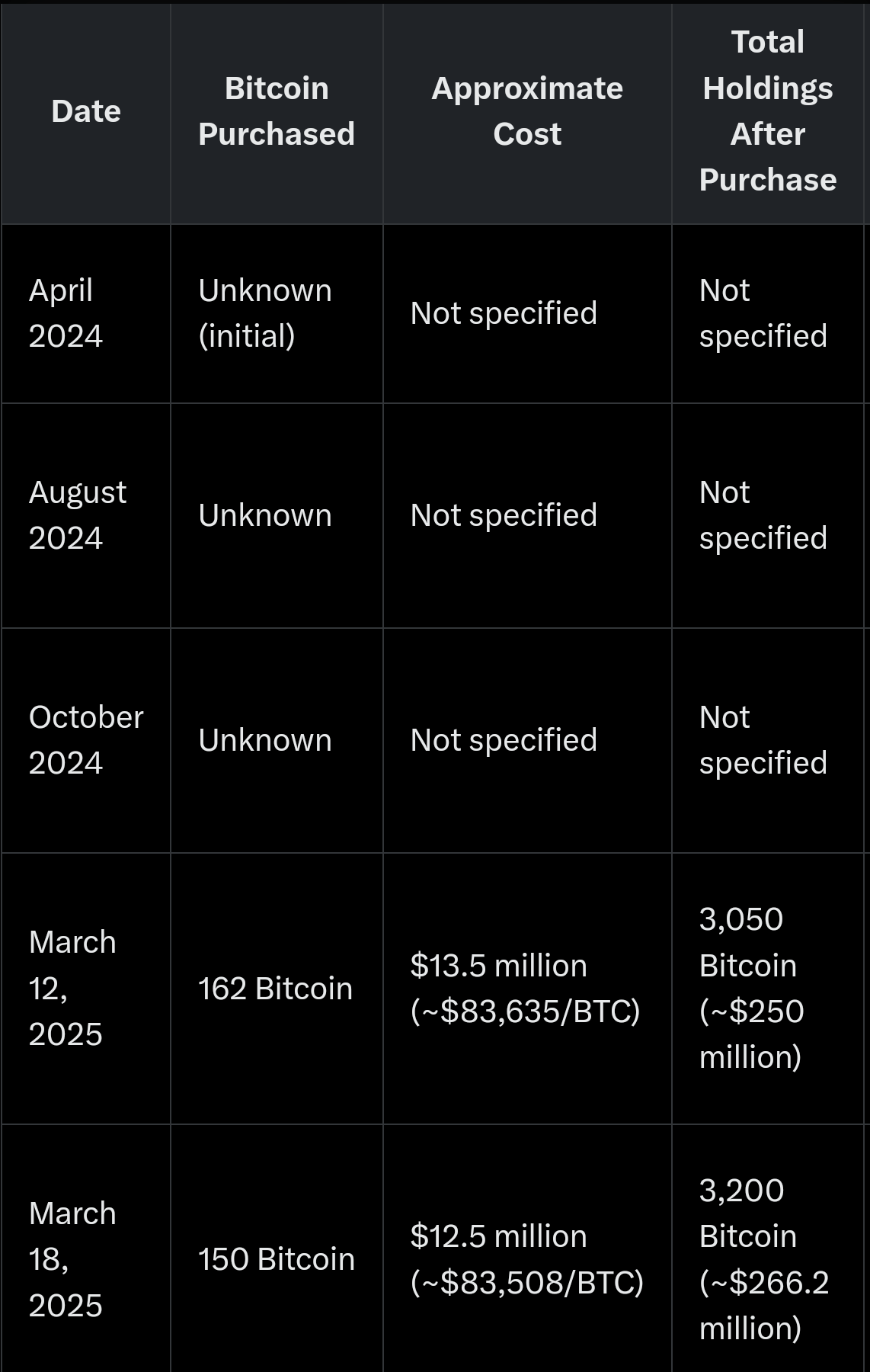

Its latest move, which was recently announced, involves purchasing 150 bitcoin for approximately $12.5 million, bringing its total holdings to 3,200 bitcoin. Preceding this purchase was a purchase made on March 12, 2025, of 162 BTC worth $13.5.

Part of this acquisition was funded by issuing 2 billion yen ($13.4 million) in zero-interest bonds. Metaplanet’s strategy mirrors that of Microstrategy, a U.S.-based company known for its massive bitcoin accumulation, and reflects a growing trend of institutional adoption of bitcoin as a reserve asset and as a hedge against traditional market risks.

Metaplanet’s move is innovative and thinking- leveraging bitcoin’s unique properties-such as its scarcity, decentralization and potential as an inflation hedge.

Using zero-interest bonds is a clever financial maneuver. It allows Metaplanet to raise capital for purchase bitcoin without immediate interest payments deferring costs until bond maturity (e.g September 2025 for the recent 2 billion Yen issuance). If bitcoin’s value appreciates significantly before that time, the strategy could yield massive returns, outpacing the cost of the bonds.

MetaPlanet is currently using this strategy to position itself in Asia and globally, with its emergence as Asia’s largest publicly listed bitcoin holder (holder of 3,200 BTC worth ~$266.2 million) underscoring its leadership in the region.

This move could inspire other Asian companies to adopt similar strategies, accelerating bitcoin adoption in a region where digital currency regulation varies but interest is growing.

Metaplanet isn’t just accumulating bitcoin—it’s building a brand around it. Initiatives like rebranding its Tokyo hotel as “The Bitcoin Hotel” (set to open in Q3 2025) and securing the exclusive license for bitcoin magazine in Japan demonstrate a commitment to education adoption and cultural integration of bitcoin. The company’s ambitious goals include increasing its bitcoin holdings to 10,000 BTC by the end of 2025 and 21,000 BTC by the end of 2026.

Metaplanet’s bitcoin acquisition strategy serves multiple purposes:

- Hedging against currency inflation: By holding bitcoin, Metaplanet aims to protect itself from potential fluctuations in the Japanese Yen and the country’s significant debt burden.

- Enhancing shareholder value: The company’s bitcoin holdings have positively impacted its stock performance, with shares surging over 3000% in 2024, making it Japan’s best-performing stock.

- Establishing a new business line: Metaplanet had incorporated bitcoin accumulation and management into its core business operation.

Metaplanet’s move is a bold, high-stakes bet on bitcoin’s long-term value driven by innovative financing and a clear vision for leadership in Asia’s digital asset space.

The strategy has short-term success (e.g., a 60.8% BTC yield in 2025) and aligns with global trends, but it carries significant risks due to bitcoin’s volatility, regulatory uncertainties, and the financial structure of zero-interest bonds. If bitcoin continues its upward trajectory, Metaplanet could see massive returns and solidify its position as a digital asset pioneer.

However, a downturn could expose financial vulnerabilities, especially if the company continues to issue bonds without sufficient cash flow or bitcoin appreciation to cover maturing debts.