Imagine a world where your morning coffee, your rent, even that spontaneous mountain hut lunch in Norway, is paid not with crumpled banknotes or finicky apps—but with bitcoin, seamlessly, invisibly, as if fiat currency never existed.

That’s the future Felix and his team are hacking into reality, one line of code at a time. But getting here wasn’t a tidy Silicon Valley fairytale. It meant sacrificing weekends, sleep, and sanity—coding late into the night after grueling days at a demanding job. It meant staring down regulatory labyrinths and reimagining money itself, all while clinging to bitcoin’s ethos.

In this interview, Felix pulls back the curtain on Wave.space’s genesis, the security guarding your sats, and why he’s betting big that Europeans will ditch euros faster than anyone expects. From bootstrapping in secret to sipping coconuts in Sri Lanka—paid for with bitcoin—this is the story of a founder who’s not just building an app, but rewiring the financial DNA of a continent.

First Steps into Bitcoin

- What is your personal Bitcoin story?

I still remember that summer morning in 2017, sitting outside with my family in Italy, enjoying breakfast. My phone buzzed with a notification: “Bitcoin rises to over €3000 per coin.” It hit me… I flashed back to 2014 when my dad casually asked over dinner, “Hey, do you know what bitcoin is? It just crashed from €1000 to €300—what’s that about?”

Back then, I didn’t have an answer, but that morning in Italy, seeing it climb back up, I realized this wasn’t some fluke. Bitcoin was real, and I had to figure it out. Since then, I haven’t gone a single day without thinking about it—it’s been a total game-changer for me.

Building on Bitcoin

- Can you share the initial spark or problem you identified that led to the creation of wave.space? What personal experiences or frustrations motivated you?

The whole idea for wave.space came from a mix of my own gripes and chats with other bitcoin builders. I was so tired of how clunky it felt to bounce between Euros and bitcoin. I mean, I wanted to live in this bitcoin world, but I still had to deal with Euros for everyday stuff—it was super frustrating!

I didn’t want to pick one or the other. My dream? To stay comfy in my Euro-based life without actually holding a single unit of Euro. That’s what we’re chasing with wave.space: turning Europeans into zero-Euro bitcoiners.

- What were some of the biggest surprises or learning curves you encountered while building wave.space?

Honestly, I think the toughest stuff is still ahead of us, but one thing that’s blown me away is how open and collaborative the bitcoin community is.

Other founders have been so willing to jump in, share ideas, and even team up. It’s been a total surprise—in the best way—and I’ve got a feeling some cool partnerships are brewing because of it. - How does wave.space differentiate itself from other services that bridge Bitcoin and traditional finance?

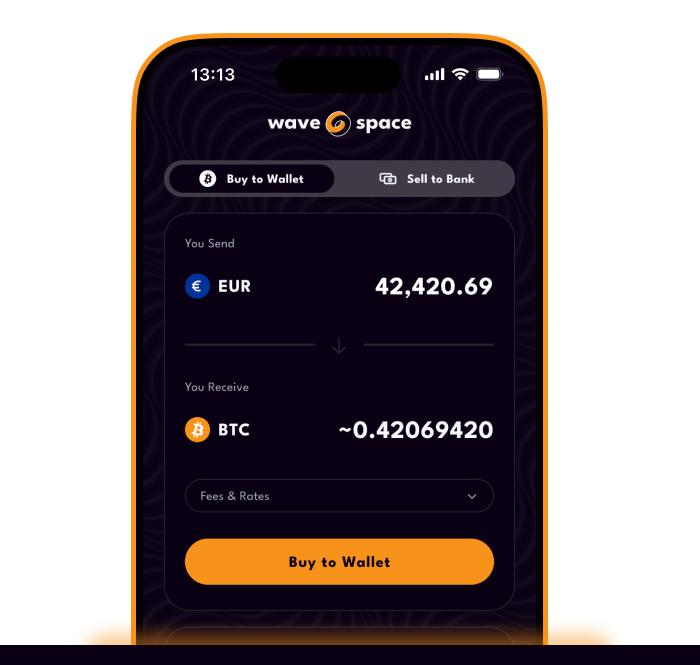

What makes us stand out is how obsessed we are with keeping things simple. We want you to hook up your favorite bitcoin wallet and bank account once, then kick back and forget about it.

No fuss, no compromise—just bitcoin made easy. wave.space is your personal perma-link to the old world–that’s it!

- wave.space emphasizes going “all-in bitcoin”. What does this philosophy mean to you personally, and how does it influence your approach to building the company?

To me, going all-in on bitcoin is about really “getting” it—it’s just better money. I keep asking myself, “If it’s better, why would I bother with anything else?” That’s the fire behind wave.space. We’re building a company that lives and breathes that belief, creating tools so people can ditch Euros entirely and jump into bitcoin without looking back.

- Can you describe the process of linking external bitcoin wallets to wave.space? What wallet types are supported?

Essentially every wallet type is supported–Legacy, SegWit, Taproot. Linking a wallet is a breeze—just type your address and hit save. Right now, you’ve got to confirm withdrawals with a 2FA SMS code, but we’re working on something cooler: a way to lock in your wallet and bank account so you set it once and forget it. Imagine never needing to log back into wave.space, while having an active perma-link set up—pretty sweet, right?

- Who is the ideal wave.space user? Are you primarily targeting Bitcoin enthusiasts, or do you aim to attract individuals new to the space?

Right now, we’re zeroing in on folks who already get bitcoin—people using self-custodial wallets who want to weave it into their daily lives. We’re all about giving them clever tools to hop between the old Euro world and the bitcoin one.

That said, we’re super excited about pulling newcomers into the fold too. Imagine one app that ties it all together seamlessly—fingers crossed we’ll nail that in 2025!

- Can you provide more details on how Swap works behind the scenes? What security measures are in place to ensure the safety of users’ funds?

While Swap feels very different to what you’re used to, it uses proven technology that is very similar to existing licensed crypto exchanges. You send us Euros, we turn it into bitcoin for you, and deposit it into your wave.space bitcoin account.

Then we nudge you to withdraw it to your own wallet ASAP. Wave.space has full exchange capabilities, but with a big emphasis on keeping your funds safe– We don’t want to hold your bitcoin if we don’t have to!

- What security measures are in place to protect user data and funds? How do you address potential vulnerabilities?

We’re playing at the highest level here—think bank-grade security. Your data and funds are locked down tight with the best standards out there. All withdrawals are secured by 2FA. Online payments with wavecard are protected with 3DS. Our infrastructure is set up just like modern online banking is.

Overcoming Hurdles in the Space

- What personal sacrifices or challenges have you faced in building wave.space?

Oh man, starting a company while juggling a full-time job is no joke—especially when that job isn’t some chill 9-to-5 gig. But when I started working on wavespace, I knew that I had to bootstrap it, in order to have the chance to build something without prejudice or pressure.

My co-founders and I basically kissed our weekends goodbye, huddling together to sketch out ideas and wrestle with the logic of it all. It was exhausting, but honestly, so exciting too. We were dead-set on not cutting corners on user experience or straying from bitcoin’s core values. Looking back, I think we pulled it off pretty well!

- Given the complexities of integrating Bitcoin with traditional banking, what were some of the early regulatory hurdles you faced, and how did you navigate them?

The regulatory stuff—it’s a huge pain in the a**… We got super lucky, though, finding a sharp team who’d already cracked the code on this. They turned their know-how into a startup, and we’re tapping into their APIs to handle all the compliance headaches. It’s been a lifesaver, and it keeps us free to focus on what we love—building wave.space.

What’s Next?

- How does wave.space engage with the Bitcoin community? What feedback mechanisms are in place?

We’re all over X and Nostr—that’s where the bitcoin crowd hangs out—and we’ve got a lively Telegram group where everyone’s welcome. We’re big on chatting with our users, soaking up their ideas, and tweaking things based on what they tell us.

It’s all about building something they actually want. We also have a Request-Feature board. Have a look, upvote & downvote and discuss existing ideas from other users, or add your own ideas to it!

- How do you believe wave.space will contribute to the broader adoption of Bitcoin and its integration into the global economy?

I think it’s all about flipping the script—why fear bitcoin’s ups and downs when we can embrace them? wave.space is here to make bitcoin so smooth to use that people start ditching fiat without a second thought. If we all went all-in bitcoin, fiat currencies would simply not exist anymore. Imagine a world where fiat’s just a memory!

- What is your outlook on the future of Bitcoin adoption in Europe, and how will wave.space play a role?

Europe’s got this amazing mix—passionate bitcoin fans, especially in places like Germany and Austria, and a banking system that’s already top-notch. People here love bitcoin’s ideas, but they don’t need it for payments because stuff like Revolut works so well. That’s where wave.space steps in—we’re making bitcoin just as slick and convenient as swiping a VISA card.

- How can the Bitcoin community help in the growth of wave.space?

Simple: dive in headfirst! Get a wavecard, use it to spend bitcoin on-the-spot in real life at over 150 million merchants. My co-founder Mantas was just in Sri Lanka and drank a coconut on the beach, paid for with bitcoin through wave.space. Eivydas was just in Norway, grabbing lunch on a mountain hut, paid for with bitcoin! That’s insane to me.

Check out wave.space, shout about it, and let us know what you need to live on bitcoin in Europe without breaking a sweat. The louder you are, the better we can build for you—we’re in this together!