With bitcoin recently trading above $105,000 and institutional interest surging, the question “Is Bitcoin mining profitable?” dominates conversations in bitcoin circles.

The short answer: Yes, but success hinges on strategic planning, cutting-edge technology, and razor-sharp cost management. We break down the 2025 mining landscape, revealing how to turn computational power into sustainable profits.

Bitcoin Mining in 2025: A High-Stakes Game?

The industry has evolved from hobbyist rigs to industrial-scale operations, with publicly traded miners like Core Scientific and Riot Platforms dominating the network hashrate. Post-2024 halving, block rewards stand at 3.125 BTC, intensifying competition. However, analysts project stable profitability this year, with production costs for top miners averaging $26,000–$28,000 per bitcoin—far below current prices according to a Canaccord Genuity research.

Factors Determining Bitcoin Mining Profitability

1. Electricity Costs: The Make-or-Break Factor

Energy consumption accounts for 70–80% of operational expenses. Miners in regions with sub-$0.04/kWh rates (e.g., Texas, Kazakhstan) gain a decisive edge. Recent innovations like immersion cooling and workload distribution have slashed energy waste, while renewables now power major mining facilities.

2. Hardware Efficiency: ASICs Dominate

Modern Antminer S21 Hydros and Whatsminer M63S models deliver 26–38 TH/s at 20–22 J/TH, outperforming GPUs by 400% according to Coinbureau. Upgrading equipment post-halving has let top miners capture more network share, but hardware costs remain steep.

3. Bitcoin Price and Network Difficulty

Profitability scales with BTC’s value. At $105,000, miners earn $328,125 per block (3.125 BTC reward). However, network difficulty’s biweekly adjustments ensure only the most efficient survive—hashrate has surged, making solo mining nearly impossible without pooled resources.

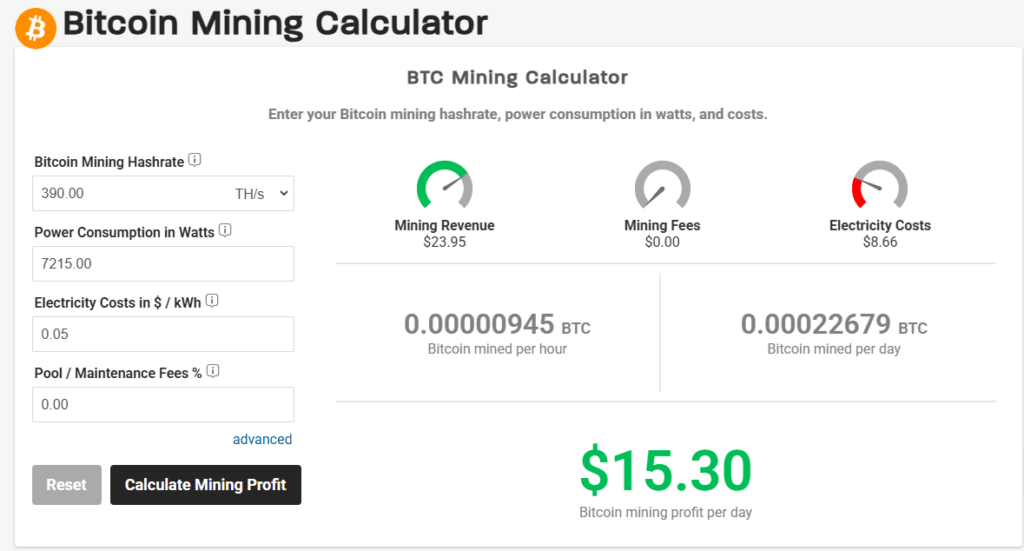

Costs vs. Rewards: The 2025 Breakdown

| Metric | Large-Scale Miner | Home Miner |

|---|---|---|

| Daily Revenue | $21,400 (0.2 BTC) | $1.16–$15 |

| Electricity Cost | $23,600/BTC | $0.10–$0.30/kWh |

| Break-Even Price | $26,000 | $38,000 |

| ROI Period | 8–14 Months | 12–18 Months |

Is Bitcoin Mining Profitable for Home Miners?

Yes, but with caveats:

- Used ASICs ($1,500–$3,000) to minimize upfront costs.

- Join pools for BTC payouts

- Target electricity rates below $0.12/kWh—earn $30–$450/month

Is Bitcoin mining profitable in 2025? For strategists leveraging cheap energy, efficient hardware, and AI integrations, the answer is a resounding yes. Remember: in this arms race, only the agile thrive.