There’s a quiet revolution happening in the global job market, and Wall Street isn’t paying attention yet. While institutional investors obsess over Bitcoin ETFs and price targets, a more profound transformation is unfolding: the emergence of a parallel employment economy that operates by entirely different rules.

Bitvocation’s newly released 2025 Annual Report doesn’t just track jobs—it exposes a structural divergence between how Bitcoin-native companies build teams versus the rest of the financial world.

For investors trying to understand where capital is actually flowing in this ecosystem, the data reveals something extraordinary: the Bitcoin job market grew 6% year-over-year to 1,801 positions, but that number masks a seismic shift underneath.

Table of Contents

The Great Bifurcation: Two Markets, Two Philosophies

The market is splitting into two fundamentally different hiring ecosystems, each with its own logic, geography, and talent requirements.

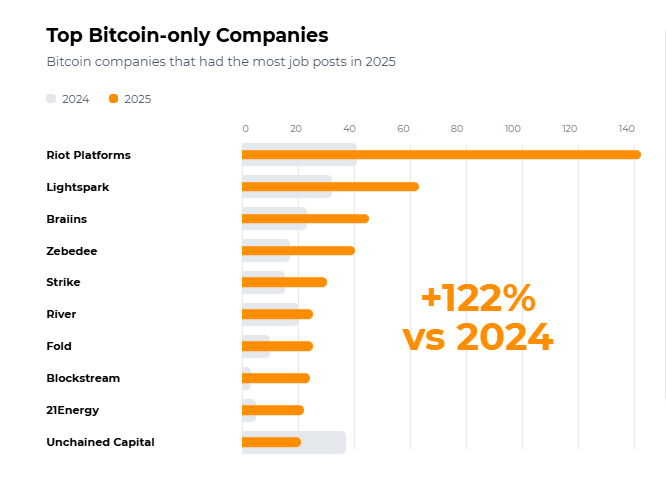

Bitcoin-only companies—firms exclusively focused on Bitcoin, not “crypto”—increased their hiring by 134 positions year-over-year, jumping from 42% to 47% of total market share. These aren’t just numbers; they represent a philosophical realignment. Companies like Riot Platforms, Lightspark, and Braiins are building distributed organizations where 56% of roles remain fully remote, unchanged from 2024.

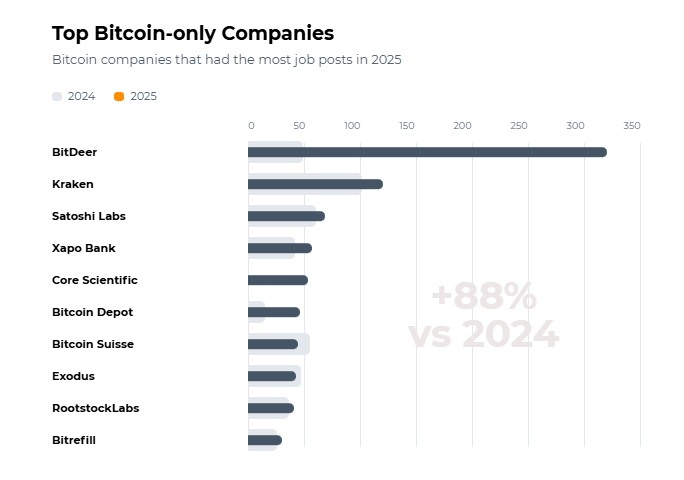

Meanwhile, Bitcoin-adjacent firms—established players like BitDeer, Kraken, and SatoshiLabs—control a concentrated oligopoly. The top 10 adjacent companies account for 85% of their market, with BitDeer alone posting 307 jobs (nearly a third of the entire adjacent ecosystem). These are the scaling giants, the institutional players, the companies with HR departments, and structured hiring pipelines.

If you’re betting on Bitcoin infrastructure companies, you need to understand which type you’re backing—because they’re playing entirely different games.

Geography: The Americas vs. Everyone Else

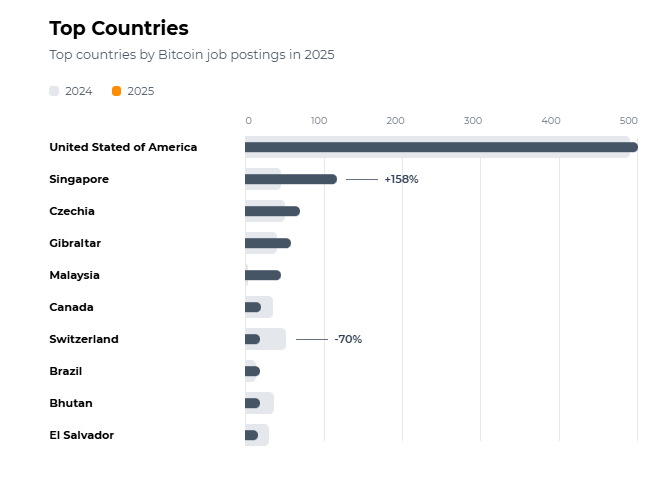

North America remains Bitcoin-only territory, hosting 309 Bitcoin-native positions—more than all other countries combined. The United States alone employs more Bitcoin professionals than every other nation on Earth.

This isn’t coincidental; it’s structural. Bitcoin-only companies cluster where regulatory clarity meets deep capital markets and a culture of permissionless innovation.

But watch Singapore. The city-state surged +158% in Bitcoin job postings, driven almost entirely by BitDeer’s aggressive expansion. It’s a reminder that Asia isn’t ceding this space—it’s just playing a different game, dominated by adjacent infrastructure and mining operations.

Europe, meanwhile, contracted sharply. Switzerland—long considered a digital asset haven—saw positions plummet -70%. Czechia holds steady, anchored by SatoshiLabs (Trezor), but the broader European decline signals something investors should note: regulatory uncertainty kills job creation faster than any bear market.

And then there are the outliers—El Salvador, Bhutan, Brazil—proof that Bitcoin-friendly policy doesn’t just attract capital; it creates employment. These nations are small data points today, but they’re laboratories for what happens when governments embrace Bitcoin as infrastructure rather than tolerate it as speculation.

The Talent Paradox

Despite 1,801 job postings, employers consistently report the same problem: they’re not drowning in applications—they’re starving for culture fit. It’s not a supply problem; it’s a signal problem.

Bitvocation’s qualitative employer survey reveals a brutal truth: Bitcoin companies need people who can “repair the wheels” (technical competence) while “believing in the destination” (ideological alignment) and “navigating unmapped terrain” (agency and ownership).

Traditional recruitment processes—resume keywords, LinkedIn filters, applicant tracking systems—fail spectacularly at identifying these traits.

The result? A “ghost economy” where strong candidates get algorithmically filtered out, and employers burn cycles interviewing people who look good on paper but don’t understand why Bitcoin matters.

This creates a hidden operational risk. If your portfolio company can’t hire fast enough—not because talent doesn’t exist, but because they can’t find it—that’s a structural bottleneck on growth. It’s why many Bitcoin roles never hit public job boards; they’re filled through trusted networks, proof-of-work contributions, and community reputation.

The “spray and pray” application method is dead. In its place: relationship-driven hiring where cultural osmosis matters more than credentials.

74% of Bitcoin Jobs Don’t Require Code

Wall Street still thinks Bitcoin is a developer story. It’s not.

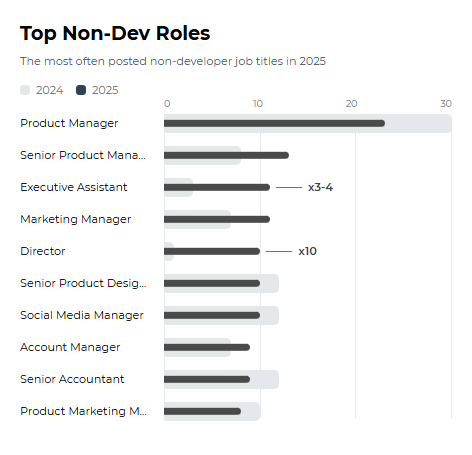

74% of the 1,801 jobs posted in 2025 were non-developer roles, up from 69% in 2024. Product Managers top the list. Director-level positions surged 10x, signaling that Bitcoin companies are maturing from “ship product” to “scale operations.”

Marketing Managers, Executive Assistants, Accountants, and Social Media leads—these aren’t ancillary hires. They’re the operational backbone of companies moving from startup chaos to institutional scale. And they require something traditional finance can’t easily train: Bitcoin literacy combined with domain expertise.

A firm that can only hire developers is constrained by its own technical tunnel vision. A firm that can attract top-tier product, marketing, and operations talent—while maintaining Bitcoin-native culture—has escape velocity.

Remote Work: The 45% Solution That’s Actually a 56% Advantage

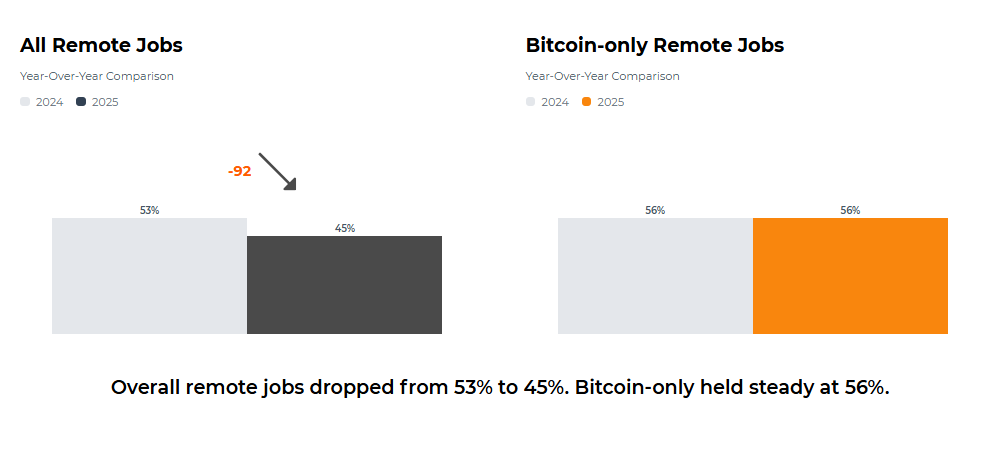

Overall, 45% of Bitcoin jobs were remote in 2025, down from 53% in 2024. But drill into Bitcoin-only companies, and the number holds firm at 56%—unchanged year-over-year.

This isn’t just a perk; it’s a competitive moat. Bitcoin-only firms can tap global talent pools without geographic constraints, while adjacent companies increasingly tie roles to specific locations (likely driven by regulatory and compliance requirements as they scale).

A company that can hire the best product manager in Buenos Aires, the best Lightning engineer in Lagos, and the best community lead in Prague—without relocating any of them—has a fundamentally lower cost structure and faster talent acquisition cycle than a company constrained to Silicon Valley or Singapore pay scales.

Bottom Line

Bitvocation’s 2025 report isn’t just a labor market survey—it’s a strategic intelligence briefing on where the Bitcoin economy is actually being built, by whom, and under what conditions.

The job market is a leading indicator. Capital follows talent; talent follows conviction. And conviction, in Bitcoin, is increasingly concentrated in a distributed network of companies that hire differently, pay differently (often in sats), and evaluate candidates through proof-of-work rather than pedigree.

For investors, the message is clear: if you don’t understand how Bitcoin companies hire, you don’t understand their operational bottlenecks, their cultural moats, or their scaling constraints. And in a market where narrative drives valuation, operational reality is where alpha hides.

The spray-and-pray era is over—in hiring, in investing, and in building. What comes next is relational, reputation-driven, and ruthlessly focused on signal over noise.

Welcome to the orange-collar economy. It’s smaller than you think, more distributed than it appears, and structured by rules Wall Street doesn’t yet understand.

But the smart money is starting to pay attention.